While cryptocurrency exchanges seem to be an overpopulated sub industry all over the world, they seem to be scarce in the U.S. market, where it gets difficult to find companies that are trustworthy, efficient and not intending to break the bank for their customers when it comes to using their services.

However, even with the increasing talks of regulations within the country over the past few years, there are exchanges that have not only been operating within the territory, but which were born in the midst of uncertainty to go on and achieve new heights of success.

One such exchange is Poloniex, which has recently garnered newfound attention due to its acquisition by Circle, a company backed by Goldman Sachs, the revered investment bank and financial institution, and Baidu, the Chinese equivalent to Google in services and local stature.

So let’s go ahead and take a virtual tour of the cryptocurrency exchange and learn more about its history before the acquisition, its present offerings, and its future plans.

History of Poloniex

Based out of Wilmington, Delaware, Poloniex was founded in 2014 by Tristan D’Agosta.

From the very start of its operations, Poloniex found a customer base in U.S. citizens who were looking for multiple options in terms of cryptocurrency trading platforms that were located within the country.

These cryptocurrency trading enthusiasts were searching for alternatives, mostly, so that they could have the peace of mind of not having to transfer their funds offshore, with no consumer protection to their name.

This proved to be a double-edged sword for Poloniex, where it did not only have to provide the latest products from the cryptocurrency industry, but also ensure that it was meeting customer expectations in terms of providing top-notch services.

With growing competition within the U.S. in the form of exchanges such as Coinbase and Gemini, Poloniex has had to work consistently to maintain the stature that it has built over the past 4 years. It currently provides its services all over the U.S. except for the following three States:

- New Hampshire

- New York

- Washington

And that brings us to Poloniex’s current offerings.

What Does Poloniex Do?

Just like most other exchanges within the U.S. and all around the world, Poloniex offers conventional trading services through its platform. Specifically, Poloniex’s services include exchange trading, margin trading, and lending.

Poloniex’s trading interface is easily available through its website, while it also offers an API to other developers to leverage its solutions.

However, the exchange does not deal in fiat trading at all. Customers cannot deposit or withdraw their funds in fiat, and everything is handled through cryptocurrencies instead.

Poloniex offers the following trading pairs through its exchange.

| BTC/USDT | MAID/BTC | PPC/BTC | CVC/ETH |

| ETH/BTC | ZRX/BTC | STORJ/BTC | NMC/BTC |

| XLM/BTC | STRAT/BTC | GRC/BTC | BCY/BTC |

| BCH/BTC | VRC/BTC | LBC/BTC | NXC/BTC |

| XMR/BTC | REP/BTC | ZEC/ETH | RADS/BTC |

| XRP/BTC | AMP/BTC | GNO/BTC | PINK/BTC |

| BTS/BTC | STEEM/BTC | GAS/BTC | XBC/BTC |

| LTC/BTC | POT/BTC | BTM/BTC | BCN/XMR |

| DOGE/BTC | DCR/BTC | NAV/BTC | HUC/BTC |

| ZEC/BTC | CVC/BTC | VIA/BTC | NEOS/BTC |

| ETC/BTC | SYS/BTC | ZRX/ETH | XVC/BTC |

| SC/BTC | ARDR/BTC | OMNI/BTC | STEEM/ETH |

| DASH/BTC | VTC/BTC | RIC/BTC | ZEC/XMR |

| XEM/BTC | BURST/BTC | FLDC/BTC | SBD/BTC |

| DGB/BTC | EXP/BTC | BELA/BTC | BTCD/BTC |

| GNT/BTC | GAME/BTC | CLAM/BTC | DASH/XMR |

| BCN/BTC | XCP/BTC | XPM/BTC | GNO/ETH |

| FCT/BTC | BCH/ETH | FLO/BTC | NXT/XMR |

| NXT/BTC | GNT/ETH | LSK/ETH | MAID/XMR |

| LSK/BTC | OMG/ETH | BLK/BTC | BLK/XMR |

| OMG/BTC | ETC/ETH | REP/ETH | BTCD/XMR |

| EMC2/BTC | PASC/BTC | LTC/XMR |

How Does Trading on Poloniex Work?

Through its exchange, margin, and lending arm, Poloniex offers a wide range of trading options to its customers.

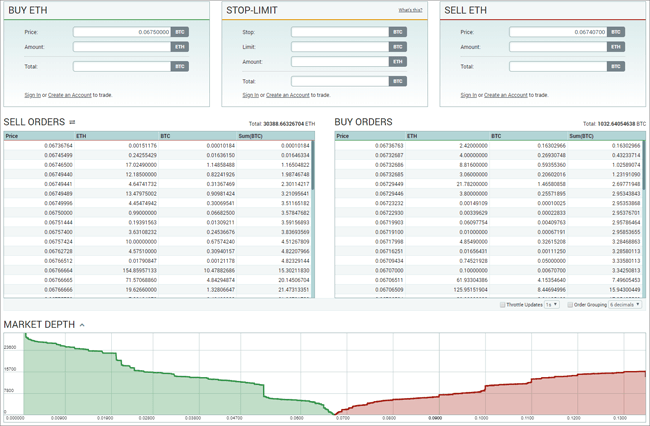

1) Exchange trading orders are placed on the Poloniex’s order books and then executed accordingly. For instance, while using the exchange service, customers can place buy, sell or stop limit orders in order to trade in cryptocurrencies (stop limit is when a user wants to buy or sell beyond a specific price).

This way, users can not only buy or sell at market price but also look for buyers and sellers who might be looking to pay a bit differently than market price according to their needs.

In cases where a trader’s asking price for a buy or sell order does not immediately meet another order on the exchange, the order remains open until a match is found.

When a match is made with a new order, the trading request gets completed.

2) In margin trading, users can request to be lent capital in cryptocurrency to make larger trades with chances of more profit than they would be able to make through normal trading by their own capital.

This is possible through trading on leverage.

At Poloniex, all of the capital used in a single margin trade by a user is lent by other users on the exchange. The user making the trade takes their chances on executing leverage. This means that if they were to make profits by executing the order at a price they wanted, they might make twice as much as they would be able to do normally. On the other hand, if the order fails from meeting expectations, then the user making the trade suffers heavy losses in return.

This makes margin trading a risky model to go with, but it remains lucrative to traders due to the incentives it provides which otherwise remain unattainable.

3) The lending mechanism on Poloniex is where users lend their cryptocurrency capital to someone making trades on margin, receiving profits from the trades in return.

And that brings us to how fees work on the Poloniex platform.

What is the Fee Structure at Poloniex?

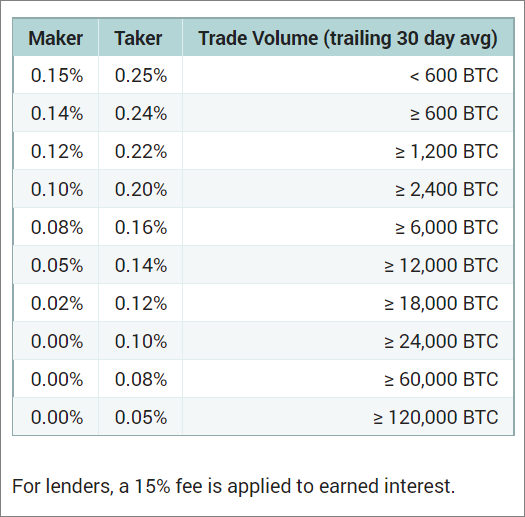

Like almost all cryptocurrency exchanges around the world, trades through Poloniex follow a maker/taker model.

This means that when someone places an order on the exchange that adds liquidity to the market, they become a market maker. Whereas, when they place an order on the exchange that immediately takes away from the available liquidity on the market, they become a market taker.

Depending upon the type of order that someone is placing and how it gets executed, they fall into either of these two categories, and the trading fee is then charged to them accordingly.

The fee charged by Poloniex is defined below.

How to Sign Up With Poloniex?

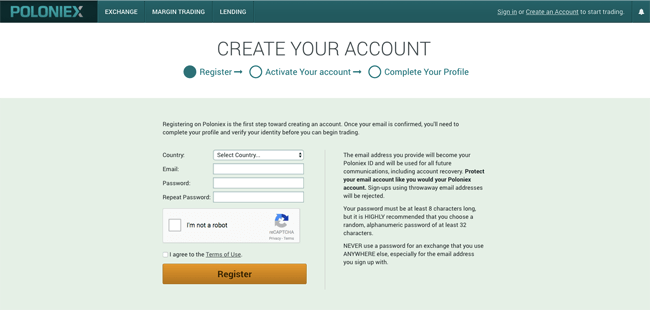

Signing up with Poloniex is simple as the process is followed through the website, but the exchange does maintain a non-compromising verification process for its customers.

While Poloniex had been lenient towards its trading process at first, where it allowed anyone to start trading in cryptocurrencies without having to provide their personal information, it later became a bit more stringent. The exchange announced in 2015, that it was going to ask customers to provide their name and country at the very least, before they could make withdrawals on the platform.

At the time, the move had seen opposition from some parts of the cryptocurrency community.

These members, took the stance that by asking for personal information, Poloniex was going against the fundamentals of privacy that come with the world of cryptocurrency trading.

The discussions grew to the point where D’Agosta wrote an open letter to the cryptocurrency community, explaining that the requirements were not being imposed by Poloniex without a reason, but because it had to comply with regulations put forth by government bodies such as the Financial Crimes Enforcement Network (FinCEN).

Since the open letter was published in May 2015, Poloniex has had to comply with additional regulations which translated into further verification requirements for its customers. These further requirements have grown to the point where the exchange now needs photo identification by its customers in some cases.

However, once the sign up process is complete, performing trading activities and making deposits and withdrawals is not that difficult.

How to Deposit or Withdraw Funds on Poloniex?

To make deposits, registered users can send their cryptocurrencies from their wallet on another interface to Poloniex’s specific addresses.

Each cryptocurrency that is eligible for deposits also has a minimum deposit limit, which is enforced to prevent network congestion with multiple smaller transactions.

The updated information is available on the deposit page of the Poloniex user interface (you need to be signed in as a registered user to access it).

The deposits are completed as soon as the respective cryptocurrency network confirms the transaction, which can take up to an hour at times, or even more in the case that the cryptocurrency network is facing issues.

The duration to process withdrawals remains the same, with the added prerequisite of the customer fulfilling a confirmation requirement through email or through their phone.

How Safe is Poloniex?

Poloniex offers industry standard protections such as two-factor authorization (2FA), where customers have to confirm certain actions by using their passwords and through providing a confirmation via their phones.

With it, it also provides its customers with the assurance of keeping the majority of their funds in cold storage, so they could remain safe from hackers due to being stored offline.

The exchange also maintains that it never uses its customers’ funds for its own operations and they are always kept for the customers to use.

Furthermore, Poloniex also boasts that it has regular audits made to its accounts and its overall operations in order to ensure transparency on all fronts.

However, before all of these measures were implemented collectively, Poloniex did fall prey to a hack in March 2014, where it lost 97 Bitcoins.

However, the exchange had taken full responsibility of the incident and repaid the affected customers in full.

After the hacking incident, D’Agosta had assured its customers that the exchange was taking additional steps to prevent such unfortunate events in the future.

“Since the hack, we implemented continual automatic auditing of the entire exchange, bolstered the security of all servers, and redesigned the way commands are processed so that an exploit like the one used in March is impossible.” He had stated at the time.

And the exchange has since made good on those promises by the looks of it, which ended up getting it the attention of a corporate-level exchange.

How is the Customer Service on Poloniex?

While Poloniex offers a ticketing system to its customers. Where dedicated support staff gets back to any customers in need of assistance, the level of customer service provided by the exchange over has been tumultuous.

Usernames Redacted In Image for Privacy Purposes. Reddit Users Can Follow This Thread for Further Information.

It was reported by various Poloniex customers that their concerns often go unresolved for days, while the customer service team seems to struggle through each and every ticket in order to resolve it in a timely manner.

A lack of response from what is supposed to a dedicated support staff can be even more frustrating when large sums of money are at play.

The customer service at Poloniex certainly needs much improvement.

However, with the recent changes at Poloniex, this customer service situation might be changing for the better.

What the Acquisition by Circle Means for Poloniex

On February 26, 2018, it was announced that Poloniex was being acquired by Circle, a company backed by Goldman Sachs and Baidu.

While Circle itself remains a peer-to-peer payment transfer solution that intends on providing services similar to PayPal, it has its operations supplemented by another associated entity which goes by the name of Circle Trade.

To put it simply, while Poloniex offers cryptocurrency trading solutions to individual customers just like how a retail store sells its products, Circle Trade offers its own cryptocurrency trading solutions to exchanges like Poloniex, acting as the wholesale provider to the resulting retail products.

Circle Trade facilitates trading operations for various cryptocurrency exchanges and handles transactions in fiat and cryptocurrency. The extent of its provided solutions can be measured by how it reportedly manages $2 billion in terms of monthly trading transactions and pegged over $60 million in its last quarterly revenue.

With the added advantage of having a corporate exchange on its back, Poloniex could very well go on to emerge as not just another exchange but a top level trading solutions provider – since Circle could get Circle Trade’s own fiat to cryptocurrency trading support integrated within Poloniex for its retail customers.

Circle is also working to enhance the level of service provided by Poloniex by clearing its backlog of issues and adding more staff to its portfolio.

“When the Poloniex-Circle integration began in late February, together we faced a backlog of 159,000 customer issues. Over the past 6 weeks, we have resolved 76,000 of those issues and added 6 new agents to our support team. We have tripled the number of engineers working on our wallet infrastructure and streamlined the process for notifying engineering when technical support is needed.”

Poloniex shared in the statement made on April 6, 2018.

For now, unfortunately, Poloniex is stuck in the middle of being the best or worst in terms of delivery and uniqueness of services. It is a safe approach to take, but it is not getting the exchange anywhere.

But with an aggressive approach, Poloniex might just become the exchange that everyone – or almost everyone – recommends to their peers in the cryptocurrency industry.