Getting started with Bitcoin shouldn’t be difficult and to help out, we’ve created a detailed introduction to bitcoin for beginners that will make things easier. Everything you need to know about bitcoin and cryptocurrency is found below. What is bitcoin and how does it work, what are blockchains, Bitcoin miners (and how does Bitcoin mining work), and how do cryptocurrencies work? These are just some of the questions we’ll try to answer.

Throughout history, people have used a variety of methods to exchange value between each other. At the beginning, people transacted with commodities with an intrinsic value such as livestock, seeds, gold, and silver. Less valuable commodities were also used, such as cowry shells or beads.

These methods of transactions were gradually replaced by coins and paper money. Later on, commodity-backed money appeared, which consisted of items representing the underlying commodity (for instance: gold certificates).

For the longest time, currencies were privately issued; governments did not claim a formal monopoly over the issue and use of money within their territories- and people were free to transact in the way the deemed proper.

But then:

As of the nineteenth century the concept of “legal tender” was introduced and governments, through sheer authority and power, created a monopoly over the issuance of currency.

With the effective abandonment of the “Gold Standard” in 1933 and the complete severance of the link between gold and currency (namely the US dollar) on the 15th of August 1971, the concept of “fiat” money could no longer be redeemed for a commodity. It is money issued by a central authority.

People are willing to accept the money in exchange for goods and services simply because they trust this central authority. Trust (“fiducia”) is crucial for this kind of money. If the public loses its trust in the central authority, the money will lose its value.

With the invention of the World Wide Web and the ongoing proliferation of the Internet, virtual communities appeared — some of which issued their own virtual currencies. In this respect, the digital currency was invented as a means of exchanging value over the Internet.

This new form of digital money is usually controlled by its developers and is used and accepted among the members of a specific virtual community.

A currency is a unit used to quantify money. Money itself is, according to its intrinsic nature, abstract purchasing power.

“When one studies the history of money, one cannot help but wonder why people have, for over 2,000 years, put up with governments exercising an exclusive power that was regularly used to exploit and defraud them. This can be explained only by the myth that the government prerogative was necessary becoming so firmly established, that it did not occur even to the professional students of these matters (for the longest time including the present writer!) ever to question it. But once the validity of the established doctrine is questioned, its foundation is rapidly shown to be fragile. We cannot trace the details of the nefarious activities of rulers in monopolizing money beyond the time of the Greek philosopher Diogenes who is reported, as early as the fourth century BC, to have called money “the politicians”- ”Friedrich

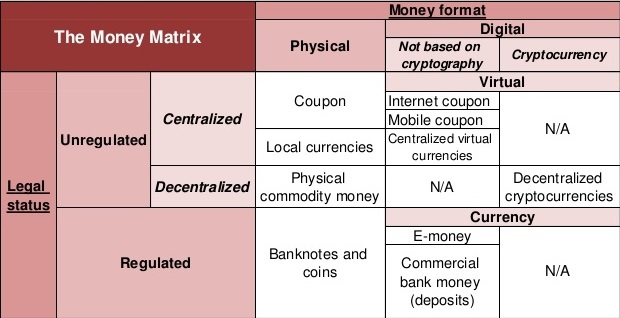

Money, virtual currency, cryptocurrency and fiat money

Fiat money

Fiat money is a currency that a government has declared to be legal tender, but not backed by a physical commodity. The value of fiat money is derived from the relationship between supply and demand, rather than from the value of the material that the money is made of.

Historically, most currencies were based on physical commodities such as gold or silver, but fiat money is based solely on the faith and credit of the economy. Because fiat money is not linked to physical reserves, it risks becoming worthless due to hyperinflation. If people lose faith in a nation’s paper currency, like the U.S. dollar bill, the money will no longer hold any value.

Virtual currency

In the process of trying to define “virtual currencies,” we run into several problems.

In fact, it is easier to define what they are not, rather than what they are. The problem becomes all the more evident when considering that a “currency” essentially requires a statutory definition. Virtual currencies, however, lack a normative definition. From the “synthesis” of this syllogism, we can easily deduce that virtual currencies are not actually “currencies” because of the legal vacuum surrounding them.

This makes them both extremely attractive and dangerous as they’re still in the “legal gray zone”. This absence of clear regulation, however, does not mean that they are not being closely monitored by regulatory agencies around the world.

Virtual currencies have traditionally been classified according to their relationship with “real money” and the “real economy”, taking into account if and how the money flow between virtual currencies and real currencies works, and how virtual currencies can be used to purchase real goods and services.

According to these characteristics, the existing virtual currency schemes have been divided into

(a) closed virtual currency schemes (that have scarce, if any, interaction with the real economy; e.g. currencies used for online games);

(b) virtual currency schemes with unidirectional flow (that implies an irreversible conversion at a specific exchange rate from the “real currency” to the “virtual currency” that can then be used both to buy virtual and real goods and services; e.g. “credits”, “vouchers”, “points” or other “bonus” systems);

(c) virtual currency schemes with a bidirectional flow (virtual currencies can be bought and sold according to exchange rates with real currencies and can also be used to purchase both virtual and real goods and services; e.g. Bitcoins).

However, the virtual currencies that are most interesting to the watchful eye of the regulators are Bitcoin, Etherium, Litecoin, Dogecoin (A satirical meme created with the sole intention of trolling the “crypto investors”) and other top-ranking cryptocurrencies on the market.

Cryptocurrency

A cryptocurrency is a form of virtual currency that uses encryption techniques as means of securing the verification of transactions. Cryptocurrencies can be centralized and decentralized, depending on the method of issuance of currency.

Bitcoins are considered to be a “cryptocurrency” specifically because they rely on a mechanism of peer-to-peer cryptography for the validation of transfers. Users can exchange Bitcoins through a mechanism of verification known as “mining” which is based on a public ledger (also known as Blockchain) that records information about the sender, receiver, time and amount of “currency” in the transaction.

When the owner of a Bitcoin transfers it to a recipient, a group of so-called “miners” consults the ledger to verify the owner’s claim of ownership, solves a complex cryptographic problem, and annotates the transfer to the recipient by logging the transaction on the ledger (where the recipient will now appear as the new owner).

As an incentive for mining, which involves the “sacrifice” of computer power and therefore huge amounts of electricity, the “miner” that solves the cryptographic problem is awarded newly generated bitcoins. This is also known as the Proof of Work method of verification of transactions.

Bitcoin is, at least in theory, a completely decentralized currency.

Status of “money” and virtual currencies

The nature of “money” of decentralized cryptocurrency is to be questioned.

The legal nature of money is traditionally identified with three functions:

(i) money as a means of exchange;

(ii) money as a unit of account;

(iii) money as a store of value.

Bitcoins (and other decentralized cryptocurrencies) are used for the exchange between a “unit of account” on one hand and (virtual or real) goods and services on the other. The first two functions normally attributed to money can be said to also be functions of decentralized cryptocurrencies.

An argument can be made that the last function, that of a “store of value” can be attributed to Bitcoin and other decentralized cryptocurrencies, and this last feature has raised major concerns because the function of “store of value” may be dangerously close to that of an “investment instrument” (that is thoroughly regulated in almost all legal systems).

The argument that Bitcoin can be considered to have the function of “store of value” is usually deducted from the deflationary monetary policy of the currency and the tendency for decreased market volatility in value over time as the market cap gets bigger and bigger and more users join in every day.

Getting Started with Bitcoin: A Bit of History

Information is power. But like all power, there are those who want to keep it for themselves. — Aaron Swartz

Below we’ll try to answer things like how does the Bitcoin market work and what is the purpose of Bitcoin plus other things you probably didn’t know about this cryptocurrency.

Bitcoin was invented in 2008 with the publication of a paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” written under the alias of Satoshi Nakamoto.

Satoshi Nakamoto withdrew from the public in the April of 2011, making further development of the currency “open source”. The identity of the person or people behind bitcoin is still unknown, although there are many conspiracy theories circulating on the Internet.

However, neither Satoshi Nakamoto nor anyone else exerts control over the bitcoin protocol, which operates on the basis of fully transparent mathematical principles. The invention itself is groundbreaking and is changing the world at an unprecedented rate.

Many experts are calling it “the biggest invention since the Internet”. Nakamoto combined several prior inventions such as b-money and HashCash to create a completely decentralized electronic cash system.

The key innovation was to use a distributed computing system (called a “proof-of-work” algorithm) to conduct a global “election” every 10 minutes, allowing the decentralized network to arrive at a consensus about the state of transactions. This elegantly solves the issue of double-spend where a single currency unit can be spent twice.

Historically, the double-spend problem was “solved” by introducing a third trusted party, usually a bank or a clearing house (or PayPal, Payoneer and such) with the sole purpose of verifying and clearing the transactions.

This traditional method raises the costs of the fees involved in transactions and creates numerous problems such as monopoly over the issuance of currency and credit, unequally distributed accumulation of wealth, and the use of centralized systems which are prone to hacker attacks just to name a few.

The bitcoin network was launched in 2009, based on the Bitcoin whitepaper previously published by Nakamoto and has since been a subject of many revisions and improvements as a result of the collaboration of many developers around the world.

Getting Started with Bitcoin for Beginners: An Introduction

“I think the internet is going to be one of the major forces for reducing the role of government. The one thing that’s missing but that will soon be developed is a reliable e-cash.” – Milton Friedman

When you’re getting started with Bitcoin you should begin with a definition of Bitcoin. As defined in the abstract of the Bitcoin whitepaper:

“Bitcoin is a purely peer-to-peer version of electronic cash that would allow online payments to be sent directly from one party to another without going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending.

We propose a solution to the double-spending problem using a peer-to-peer network. The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work. The longest chain not only serves as proof of the sequence of events witnessed but proof that it came from the largest pool of CPU power.

As long as a majority of CPU power is controlled by nodes that are not cooperating to attack the network, they’ll generate the longest chain and outpace attackers. The network itself requires minimal structure. Messages are broadcast on a best effort basis, and nodes can leave and rejoin the network at will, accepting the longest proof-of-work chain as proof of what happened while they were gone.”

The “invention” of fire and cooking meat enabled homo sapiens to stay warm, survive and prosper. It accelerated the growth of our brains and as a consequence the growth of our population and culture. The invention of the wheel enabled us to carry goods and transact value in even longer distances than before.

The invention of the printing press, the compass, electricity, transistors and telegraphs, computers and finally the World Wide Web drastically shifted the course of history forever. Today, we live in an age of great novelty, and the invention of Bitcoin (and the underlying technology behind it – the Blockchain) is most certainly the biggest invention of the 21st century.

For the first time in modern human history, we can send and receive all kinds of information and data and exchange value over great distances without having to rely on any trusted intermediary. For the first time in modern human history, fiat money has been seriously challenged.

Today we have a battle of currencies, all of them with different monetary policies and purposes on the free and open market, making the dream of the Austrian school of economics come true. But let’s cut romanticizing and explain how all this works:

How does the Bitcoin protocol actually work?

Explaining the workings of decentralized cryptocurrencies is most effectively achieved through the explanation of the Bitcoin protocol.

1. Creation of coins – Mining

The most misunderstood thing about the process of “mining” is the confusion between the incentive and the goal of the process. Most of the people familiar with the cryptocurrency world consider mining as a means of creating new coins and making a profit of it.

That’s a reversed and wrong way of looking at it. The real reason for the existence of miners in the Bitcoin protocol is verification and clearing of transactions. The issuance of new currency (new Bitcoins) is, therefore, an incentive/reward for the sacrifice of computing power/electricity.

How does Bitcoin mining work?

What is Bitcoin mining actually doing? Some of the nodes on the Bitcoin network are specialized nodes called miners. They run a “mining rig” which is a specialized computer-hardware system designed to mine Bitcoins.

The miner node is actively “listening” for valid new transactions, collects them into a pool of unconfirmed transactions and aggregates these transactions into new blocks.

Now that a candidate block has been constructed, it is time for the miner’s hardware to “mine” the block, which means to find a solution to the proof-of-work algorithm that makes the block valid. As a reward, the first miner to find the solution to the proof-of-work mathematical riddle gets to keep these new Bitcoins created out of thin air in the process.

After the miner has successfully mined the block, he immediately starts propagating it across the network of nodes in the peer-to-peer Bitcoin protocol for further validation, as each node performs a series of tasks for validating it before propagating it to its peers.

The independent validations also ensure that miners who act honestly get their blocks incorporated in the blockchain, thus earning the reward. Those miners who act dishonestly have their blocks rejected and not only lose the reward, but also waste the effort expended to find a proof-of-work solution, thus incurring the cost of electricity without compensation. Because the block reward will decrease over the long term, miners will someday instead pay for their hardware and electricity costs by collecting transaction fees.

The sender of money may voluntarily pay a small transaction fee which will be kept by whoever finds the next block. Paying this fee will encourage miners to include the transaction in a block more quickly.

This is how Bitcoin mining works. How much can you make mining Bitcoin? On paper the possibilities are endless.

2. Blockchain – Distributed Public Ledger

A blockchain is a continuously growing list of records called blocks, which are linked and secured using cryptography. Each block typically contains a hash pointer as a link to a previous block, a timestamp and transaction data. By design, blockchains are inherently resistant to modification of the data.

A blockchain can serve as an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way. For use as a distributed ledger, a blockchain is typically managed by a peer-to-peer network collectively adhering to a protocol for validating new blocks.

Different cryptocurrencies run on different protocols (or “rules”) and therefore different blockchains. So why is the blockchain so special?

Well, basically the blockchain allows for irrefutable record keeping of any sort of information. Once recorded, the data in any given block cannot be altered retroactively without the alteration of all subsequent blocks, which requires collusion of the network majority. Every block contains within itself the hash of the previous block called “parent block” therefore creating a chain of blocks- hence the name.

The real beauty of the invention are the countless use cases for it: from decentralized cloud storage to digital voting platforms, digital identity protection, decentralized notary, a blockchain-based land registry, all the way to various business uses like using blockchain to track shipping cargo, decentralized communication platforms, and others. A truly revolutionary invention.

You don’t need to know all of this when you’re just getting started with Bitcoin but it does help out to know more, wouldn’t you say?

3. Ownership of Bitcoins – Wallets, keys, and addresses

Ownership of Bitcoin is established through digital keys, Bitcoin addresses, and digital signatures.

I’ll explain all of these terms:

When we think about digital keys in terms of the Bitcoin protocol we’re thinking about the Private and Public key. The Private key is usually picked at random (generated from a source of entropy) and is known only to the owner of the funds (the wallet).

The private and public keys come in pairs, namely, the public key is generated using an elliptic curve multiplication (a one-way cryptographic function) and the Bitcoin address is furthermore created out of the public key using a one-way hash function.

Now before you ask yourself why should you care about all this technical jargon, let me clarify it beforehand. The Bitcoin address is what appears most commonly in a transaction as the “recipient” of the funds. If we were to compare a bitcoin transaction to a paper check, the Bitcoin address is the beneficiary, which is what we write on the line after “Pay to the order of”.

On a paper check, that beneficiary can sometimes be the name of a bank account holder, but can also include corporations, institutions, or even cash. Because paper checks do not need to specify an account, but rather use an abstract name as the recipient of funds, they are very flexible payment instruments. Bitcoin transactions use a similar abstraction, the Bitcoin address, to achieve the same flexibility.

4. Wallets

Getting started with Bitcoin requires a wallet. First things first. The term “wallet” is kind of misleading because it creates the illusion that your Bitcoins are stored in your wallet. That’s wrong. Your Bitcoins are stored as “Unspent Transaction Outputs – UTXO” on the Blockchain.

The private and public key pair that is used to access those funds is stored in the wallet. So technically, the “wallet” is a keychain storing the keys that enable you to access your funds locked on the blockchain. Users sign transactions with their keys, thereby proving they own the transaction outputs (the coins).

In effect, there is no such thing as a stored balance of a Bitcoin address or account; there are only scattered UTXO, locked to specific owners. The concept of a user’s Bitcoin balance is a derived construct created by the wallet application. The wallet calculates the user’s balance by scanning the Blockchain and aggregating all UTXO belonging to that user.

а) How to use a wallet?

If you do a little googling, you’ll find that there are dozens of crypto businesses that offer wallet software. There are many types of wallets: ones that store one or multiple cryptocurrencies, desktop wallets, mobile wallets, hardware wallets and so on.

Which type of wallet you chose to use depends on your needs and preferences. Once you’ve chosen either a software-based wallet or a web-based wallet, it all comes down to a simple registration process.

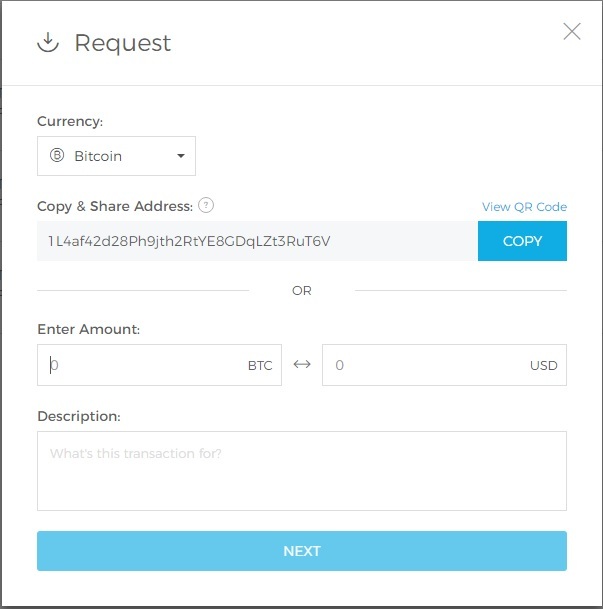

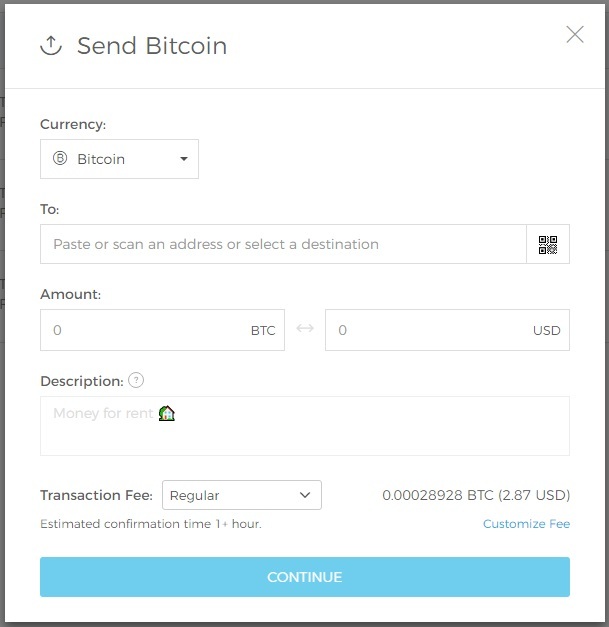

b) How do I send and receive cryptocurrency?

How to open a bitcoin wallet? Creating a wallet means you have already created an address which represents your “ID”. You can use your address to receive cryptocurrency. Just copy and share your address and wait for the funds to arrive. Simple as that.

If you want to send cryptocurrency, just copy and paste the recipient’s address into the destination bar and click send.

5. Is it Secure?

The safest way to buy Bitcoin (especially if you’re a beginner) is to use a good wallet and buy Bitcoin from known sources. Do this when you are only getting started with Bitcoin and stay safe. When you’re dealing with money, security is of ultimate importance, and even more so when you’re dealing with decentralized cryptocurrencies.

There are two sides to a coin, and cryptocurrencies are no different. By removing the third trusted party from the equation, all the responsibility falls on your shoulders. In order to send a transaction, you have to sign it with your private key — and the key is called private for a reason.

If anyone, through any means gets your private key, he basically has ownership over your funds and can send transactions. If you lose your private key or the password to your wallet as many people have done (an estimated over $30 billion of Bitcoins have been lost up to this point), they are lost forever – yes, this is a scary number especially if you’re just getting started with Bitcoin.

There is no central authority you can contact and work it out- they are gone for good! Just like that! History! So be careful with your funds- and spend extra time securing them. Cold storage may be the place you can start.

What is the best Bitcoin wallet? Learn which is the best Bitcoin wallet for your particular needs and also find out tips and tricks on using it. We’ve compiled a list of 10 top Bitcoin wallets.

6. Okay, I have my wallet, now where can I buy cryptocurrencies?

There are two methods of buying cryptocurrencies, online and offline (or tet-a-tet). In order to buy cryptocurrencies online, once you have your wallet to store them, you can find someone on the Internet to sell them directly to you, or you can sign up on an exchange site like Coinbase (probably best place to buy and sell Bitcoins), Kraken, Cex.io etc. and buy cryptocurrencies using fiat.

The most anonymous method of getting cryptocurrencies is buying them tet-a-tet for cash. There are various sites and pages where you can arrange a meeting with someone that is willing to sell you cryptocurrency for cash.

For starters, you can try LocalBitcoins or try the old “friend of a friend” method and ask around for help!

You prefer video?

Well then here’s a good video guide to getting started with Bitcoin, why you should invest in Bitcoin, what is the purpose of Bitcoin, etc. Long story short, what is Bitcoin and how does it work. I love this explainer:

To sum it all up… getting started with Bitcoin can be difficult at first glance but once you know more about cryptocurrency and Bitcoin, things get easier.

The author of this text only hopes to have provided a concise, in-depth and yet simple guide down the rabbit hole that is the cryptocurrency world and to help anyone whose thinking of getting started with Bitcoin and/or are interested in learning how to make money with cryptocurrency.

Hopefully, the theoretical and technical aspects of cryptocurrencies covered in this introduction will be enough to spark an interest in this subject and offer a starting point to a deeper understanding of what cryptocurrencies are all about.

Featured image by Alex Kunchevsky