The performance of many cryptocurrencies in terms of price appreciation and growth in 2017 can best be described as stunning. There were even late performers: cryptocurrencies like Ripple (XRP) saw some good moves in December 2017.

As it is, many people want to benefit from the kinds of movements which were seen in cryptos such as Ripple, Neo, Zcash, etc. Who wouldn’t? Let’s delve into the best cryptocurrencies to invest in 2018:

Unlike any previous investment vehicle that’s known to man, cryptocurrencies are the first vehicles that have delivered amazing wealth and returns to ordinary people while the major players in the global economy (the big banks) are locked out.

In case you did not know it, the big banks are not in cryptocurrency investments yet because the regulatory framework under which they operate prohibit them from doing so. So they have been forced to sit on the sidelines and watch average Joes take money from this market.

When you consider that most of these banks make insane amounts of money from the forex market while only 5% of retail traders are profitable, you can see how much of a big deal this is. If you check around many online forums, the popular question around this topic is:

What are the “cheap” cryptocurrencies that can explode in price in 2018?

This question may look rational, especially since Bitcoin started off at 1cent per BTC way back in 2008 and many cryptocurrencies which are doing two or three digits in price all started off as pennies.

However, there are more than 1,000 cryptocurrencies in the market presently and many of them are in the dump with no hope of ever getting away from their penny prices. So if the focus of the wannabe crypto investor is solely on buying cheaply priced cryptocurrencies with the hope of making X50 or X100 the present price, then this is definitely a wrong approach.

That is not to say that there are no altcoins that are priced very cheaply (i.e. less than $1) which will achieve such returns in 2018. However, it is a bit of a challenge looking for such cheap altcoins in the haystack of cryptos that we presently have in the market.

So what should be the approach to adopt in searching for the altcoins that will make these amazing returns for you in 2018? You need to have a strategy in place, know what cryptocurrency vehicle to invest in, know when to invest in your selected cryptocurrency, and have a great exit strategy.

The Best Approach

The best cryptocurrency investment for 2018 will not stand out from the crowd, which is why many people do not know about them until the opportunity is as good as gone.

Bitcoin, Ethereum and many of the three-digit cryptocurrencies now have made a lot of good gains, but they will not be the kind of cryptocurrency investments to look for in 2018. Yes, there is a lot of noise about Bitcoin going up to $50,000 from certain quarters, but do not expect that to happen so soon.

Rather, the best cryptocurrencies to invest in are:

- Altcoins which have value and actually solve real problems or have a real product attached to them.

- ICOs featuring altcoins that do exactly the same (have a real product which gives them value).

ICOs are easily the best cryptocurrency investments you can get into for 2018. Now don’t be misled. There are many junk ICOs where there is no real product and no strong team backing them.

These sort of ICOs are destined never to take off the ground. The best ICOs to invest in are:

- Those that offer tokens designed to solve real problems in an ecosystem.

- Backed by a very strong team

Let us use a real-life ICO example to illustrate why you should consider ICOs as a good cryptocurrency investment vehicle for 2018. The example we shall use is that of Dragon Chain (DRGN).

Dragon Chain was introduced as a cryptocurrency that would solve the problem of excessive cost and charges in arranging money and transferring payments of junket players in Macau’s casinos. Typically, a junket needs to mobilize a minimum of $100 million in cash for its casino game stakes.

Arranging this money comes at a great cost, as up to 5% of the total amount that a junket mobilizes on a daily basis is paid as transaction costs. Imagine a situation where a junket has to pay a total of $10m as costs in arranging $200m in staking liquidity.

That is a massive cost which eats into profits of casinos and junkets. Gamers who win must sometimes part with as much as 7% of their winnings as transaction costs in repatriating their takings. Obviously, a payment system which cuts such costs to as low as 1% is extremely desirable, and that is what the Dragon Chain (DRGN) altcoin aims at achieving.

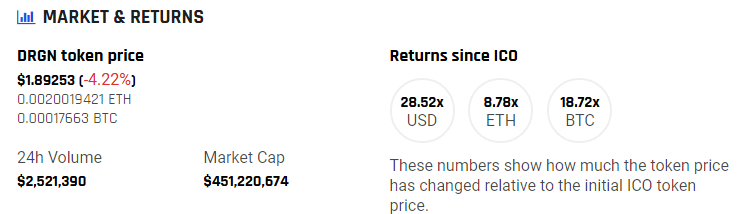

The token was sold in the November 2017 ICO at a cost of $0.0633 per token. Presently, that token now goes for $1.89, which represents a 28 fold increase in value. An investment of $633 would be worth $20,000, all in under 2 months. Does this sound good to you?

If this sounds good to you, here are some guidelines to use to find the best cryptocurrency investments for 2018.

-

Choose Platform-Based ICOs

Cryptocurrencies were created as the media of exchange for projects and platforms that run ecosystems.

Bitcoin is actually outdated when it comes to this function. It is slow and does not provide smart contract support like Ethereum does. We just mentioned the case of DRGN that solves a problem within an ecosystem.

If you look around, there are many ecosystems which presently have inefficiencies in terms of cost, ease of use, scalability, global deployment, etc. That is why ICOs which market tokens on platforms that solve these inefficiencies are created are worth looking at.

Part of the reason why Ripple took the market by storm is that the platform it powers (RippleNet) is created to solve the challenges associated with cross-border payments at the banking level. So when deciding on which ICO or altcoin to invest in, look at the underlying platform and see if it solves a major challenge in an ecosystem.

-

Anticipate What the Market Wants

Follow the crypto news to see what current market expectations are, and buy the cryptos that are developed as solutions to follow those trends. For instance, Litecoin has just been incorporated into the first truly crypto-based e-payment system for e-commerce merchants.

The announcement of this system known as LitePay catapulted the price of Litecoin from about $130 per LTC to $232 per LTC in 2 days. You can be sure that increased adoption will cause the price of Litecoin to push even further.

LTC/USD Chart Showing Price Response of Litecoin to Announcement of LitePay. (c) LINEFAR Project

Litecoin was created as an improvement in Bitcoin, delivering faster transaction times, more blocks per mining cycle, stability and less expensive to run: three factors that make this coin more amenable to deployment as an e-commerce payment solution.

So the lesson here is that you should watch for cryptocurrency platforms that solve basic issues with current blockchain technology. Here, we are talking about real-life situations.Some of these problems that MUST be solved are:

To give you a heads-up, consider investing in cryptos which provide the following:

- Improvement in existing blockchain technology

- Improving money remittance inefficiencies

- Decentralized Exchanges

- Sports Betting

-

Look at Market Capitalization

The market capitalization of cryptocurrencies (MarketCap) can be found on CoinMarketCap.com. You should aim to buy altcoins with a lower market cap. Cryptos with lower marketcap tend to have more room for growth. An altcoin with a marketcap of 18,000,000 can easily attain 6 times growth to 108,000,000.

But an altcoin with a marketcap of 500,000,000 will have to get to 3,000,000,000 marketcap to achieve the same 6-fold growth. Of course, there are few exceptions to this rule. Try to look for altcoins or ICOs with marketcap of between $20million and $50 million.

-

Pick ICOs with a Strong Team

Credentials speak volumes. Choose ICOs with team members who are known within the crypto or investment ecosystem, have good track records and have worked for very successful ventures. Look for ICOs where team members are well connected within the ecosystem the ICO project intends to operate. LinkedIn is an awesome resource in this regard.

-

Watch the Fundamentals

What are the fundamentals? Fundamentals cover things like:

- Available/total supply of the cryptocurrency

- Marketcap

- Purpose of coin’s creation (must have real-life applications)

Websites like ICOdrops.com give such information for most coins in the market. For instance, if a coin has already been 80% mined and has a strong concept behind it, you can be sure that the supply limitation and demand will cause an increase in the value of this coin down the road.

-

Met/Unmet Demand

Look at the level of demand that could not be met in the ICO because of the hard cap limitations. Usually, in an ICO, there is a hard cap, which is the maximum amount of money that the ICO can raise. Any excess has to be returned to investors.

This creates a situation where some ICOs have whitelists, which is a form of pre-selection of who can buy into an ICO using an email signup process. Unmet demand usually means that many people who were locked out of the ICO process will rush to buy the tokens once listed on exchanges, leading to spikes in price.

Unmet demand can be gauged by the following metrics:

- ICO requires a whitelist, and whitelist is difficult to access.

- The number of investors in whitelist is capped.

- Small-cap per whitelist

- Strict Know Your Customer (KYC) protocols which must be met before being allowed to invest in ICO.

- Country restrictions, especially if countries with large number of crypto investors are locked out (China, South Korea, USA)

- Limited or No Bonus allocations in the pre-ICO sale.

-

ICOs Whose Token Has a Product

Though not a strict requirement, an ICO whose token has a product with a real-life application is likely to do well after the token is released following an ICO.

-

Study the White Paper for Technical Details of the Token’s Application

Only invest in altcoins or ICOs where a clear-cut description of the application of the token is described. It is shocking how many people simply put money into an ICO without reading the white paper.

-

Buy into Pre-Sales

ICOs are usually preceded by what is known as the pre-sale. The pre-sale is like a private placement in the world of corporate business. Here, the first investment opportunity is given to those with a sizeable amount of cash to purchase tokens at dirt-cheap prices.

For every token, the process of investment from concept to listing follows this trajectory:

Presale -> Public Sale (ICO) -> Exchange Listing

ICOs are offered at prices which are higher than pre-sale prices. Furthermore, pre-sales usually come with bonuses that may be as high as 300%. If you can buy into presales, this is where you should be investing. Furthermore, you do not have to put up with the whitelist and allocation restrictions of ICOs.

The problem is that the capital requirements required for pre-sale investments are high. So if you do not have the funds, you can form a group of like-minded investors, pool cash together and make the purchase.

To be able to purchase presales, you need information. This information can be obtained from Telegram groups, blockchain industry meet-ups and from the following websites:

- Icodrops

- Icoalert

- Crushcrypto

-

Buy ICOs with Value

You should only look at ICOs whose tokens solve real-life challenges. These are the tokens that can do up to 50 or 100 times their ICO price in a short time. Look at these tokens:

- Ethereum

- Neo

- Aion

- ICON

- Wanchain

- Zilliqa

- OMG

Hope you got an idea on how to find the best cryptocurrencies to invest in 2018. Share your views in the commens below. And if you’re new to cryptocurrency and Bitcoin check out our getting started with Bitcoin guide.

Feature image liquidinkdesign