Amidst the cryptocurrency market’s recent bearish demonstration, rumblings about forthcoming index funds have grabbed the attention of many investors both, in and out of the industry. With the digital currency market achieving a cumulative market cap of close to 1 trillion US dollars a few months ago, it has finally defined itself as a competitive asset class for potential investors.

What The Future Will Look Like?

The idea of managed funds in cryptocurrencies comes not too long after CBOE and CME Group, two large options exchanges, introduced bitcoin futures contracts. Given the relative success of this move, it is no surprise that the regulated financial world is closing in on more opportunities with digital assets. However, while the market’s extreme volatility actually favors futures contracts, the same can not be said for index funds. At the end of the day, profit maximization is the top priority for any such fund.

Index funds have been a traditional financial instrument for close to half a century now and were first popularized by the famous investor, John Bogle. Since then, these funds have evolved to offer investors a quick entry vector into an entire set of options. A common example of such an index is the Standard and Poor’s 500, also known as the S&P 500. It includes a set of five hundred large American companies that have their stock listed on the New York Stock Exchange or NASDAQ.

Unlike hedge funds, where most of the investment amount is typically concentrated in a handful of offerings, index funds allocate the money across an asset class, mitigating the total risk by an appreciable amount. The Vanguard 500 Index Fund, for instance, has shown a return of an average of 11 percent since its inception.

In the future, as index funds presumably ether diversify into smaller digital assets or include them with some larger ones, investors will also be able to invest directly in blockchain technology related companies instead of pure cryptocurrencies.

What is an Index Fund?

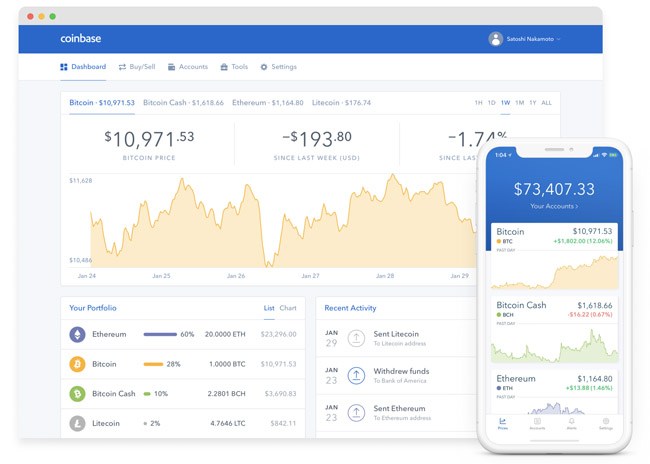

Perhaps the best explanation of index funds is given by Coinbase, a relatively well-known company in the cryptocurrency space that recently announced its own such fund. In its blog post announcing the Coinbase Index Fund, it said, “Index funds have changed the way that many people think about investing. By providing diversified exposure to a broad range of assets, index funds enable investors to track the performance of an entire asset class, rather than having to select individual assets.”

It is important to note though, that in the cryptocurrency market, there is no such thing as a conservative investment. Even with index funds offering a reduced reliance on one particular digital asset, many will argue that the volatility of the market as a whole makes these funds a risky investment vehicle.

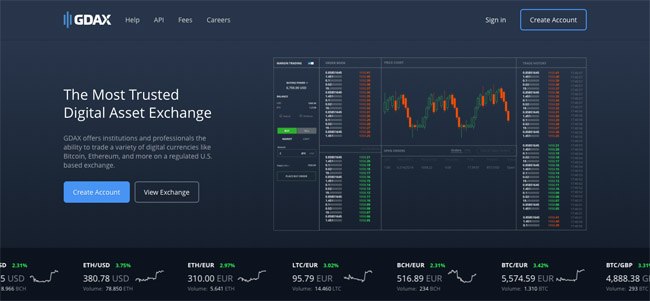

Nevertheless, Coinbase will be offering the index funds in question exclusively through its trading platform, GDAX. At the time of writing this article in March 2018, GDAX alone accounts for most of the total trading volume in the United States. It is easily defeated, however, by international exchanges such as Binance and Bitfinex, the former of which is responsible for most of the altcoin trading in Asian countries such as South Korea.

In the framework paper released by Coinbase, it is clear that the company will only be working with cryptocurrencies that it already offers on its trading platform. At this time, trading on GDAX is limited to a very small, albeit popular, subset of the market, including Bitcoin, Ethereum, Litecoin and Bitcoin Cash.

For a new asset to be included in the Coinbase index fund, it will need to conform to the GDAX digital asset framework and also be added to the platform. However, it was only a month ago when the exchange stated that it had no intentions to bring new cryptocurrencies to its platform in the immediate future.

There are also several restrictions on who can invest in the Coinbase index fund, as the company stated, “At this stage, investing in Coinbase Index Fund will only be available to US-resident, accredited investors.” Given the compliance overhead when working with different governments, the company is possibly trying to iron out any issues with the US Securities and Exchange Commission before moving forward.

Index funds typically work on the basis of weighted exposure, wherein the best performing assets are assigned the highest percentage of the total investment. Confidence is also a major contributing factor to the percentage, as a high valuation may sometimes be an anomaly or a temporary event.

Given that Bitcoin dominance over the entire cryptocurrency market is currently a whopping 42 percent when measured relative to total market capitalization, it is quite obvious that it will account for the lion’s share of any index fund that includes it. The index fund offered by Coinbase is no exception to this rule, with Bitcoin awarded 62 percent allocation of the entire fund.

Ethereum and Bitcoin Cash are allocated the second and third highest percentages in the Coinbase index fund. The overall positions will always be synchronized to their standings in terms of market cap, especially as the metric has become the de facto method of comparing the standings of different cryptocurrencies.

A closer inspection of the methodology document released by Coinbase reveals that the company does indeed account for the market cap of a cryptocurrency while calculating its index level. In fact, Coinbase’s paper offers a complete breakdown of the mathematical formula it uses.

In the traditional finance sector, index funds are often used as a way to diversify one’s holdings in different stocks and companies. This way, if one of those stocks were to collapse or crash by a large margin, the investor would not suffer While the same logic can be transferred over to cryptocurrency index funds, the advantage of participating in one is vastly diminished in comparison.

Unlike the stock market, where companies’ valuations are relatively independent of each other, digital currencies tend to move up or down in unison. A common explanation for this is the overwhelming popularity of altcoin trading pairs with Bitcoin and Ethereum. Given that only the top one or two cryptocurrencies have sufficient liquidity with fiat pairings, it is common to see the entire market express bullish or bearish sentiment collectively.

That is not to say that cryptocurrency index funds have no purpose though. In the event that the cryptocurrency market undergoes a tectonic shift of some sort and ends up favoring the fifth or sixth largest digital token, investors in the index fund will likely be better off. Even though Bitcoin and Ethereum are good investments today, that may not always remain to be the case.

Coinbase is not the first company to unveil cryptocurrency oriented index funds though. In December 2017, Bitwise Asset Management announced that it had begun accepting investment capital for Hold 10, a moniker used for the index fund offered by the company. Hold 10 was introduced to the public as a way for investors to invest in the ten largest cryptocurrencies currently on the market.

With Bitcoin futures, cryptocurrency hedge funds and now, index funds all being launched within the past year or so, it is clear that the asset class has attracted the attention of Wall Street and the financial markets at large. According to some financial experts, the changing landscape may equate to an overall increase in legitimacy for the entire digital currency market.

Where are the Index Funds Available?

Image credits:

As of right now, cryptocurrency index funds are only being offered in very select geographic regions and to a very small subset of the population at large. Coinbase, for instance, has announced that it will only cater to accredited investors for the time being and has not released a timeline for the mass rollout. It has, however, confirmed that a collection of funds will be made available to the general public at some point.q

Now that users and retail investors are no longer the only consumers of cryptocurrencies though, many are beginning to question the future of decentralized assets. When Bitcoin was introduced in 2009 by its creator, Satoshi Nakamoto, it was heralded as the world’s first decentralized and paperless currency. With the mentality of the public moving towards that of a speculative investment, it is looking less and less likely that Bitcoin, or any other cryptocurrency for that matter, will be able to achieve Nakamoto’s original vision.

Regardless though, there are some positive ramifications for the cryptocurrency market embedded within this news. An increase in usage by traditional financial institutions will lead to cryptocurrencies finally being properly regulated by governments across the world. It is no secret that, at this time, the digital asset market is basically the wild west of investment, with scams and fraudulent schemes to be found by the dozen.

It can perhaps be argued that cryptocurrency financial products, such as the ones offered by CBOE, CME and now, Coinbase, are pushing the market forward. Save for instances of clear market manipulation, there is little reason to object against them since they very likely represent the future of the digital currency market.

Featured image