It is an established fact that the investments from initial coin offerings (ICOs) are known to be more popular and prominent in the blockchain community.

In fact, despite the many controversies and the numerous dead projects that have resulted from ICOs in the past, the number of ICOs conducted in 2018 so far has already surpassed the total number of ICOs conducted in the year of 2017.

However, even with the growing popularities of ICOs, the importance of VC funding cannot be denied.

While the first ever ICO only dates back to July 2013, VC investments predate that mode of fundraising by almost a year, with the first VC funding round for a blockchain startup being conducted in September-October 2012.

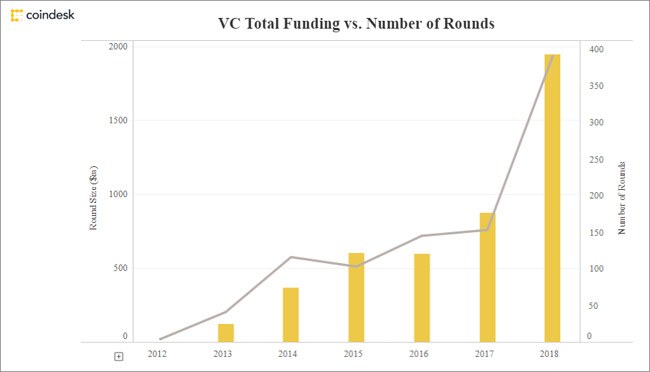

And since then, such funding rounds have also increased in their frequency each year, with VC investment also surpassing their annual total from last year within a record 5 months into 2018.

Venture Capital Historic Graph, Coindesk

The Impact of VCs as compared to ICOs

What makes VC investments different from ICOs is their expected corporate reliability, ease of execution, and their impact on a company’s credibility in the business sector.

As opposed to a new startup that has only raised funds from ICOs, a project that has raised funding from already established capital entities is supposed to garner more trust from future investors.

Most people perceive existing VC investments as a sign that the project has already been pre-vetted by a competent third party, who would have only invested in it if it found the venture to be reliable. This third party due diligence and investment shows confidence in the project.

Retail investors look at the actions taken by the venture capitalists and feel that they would be safe as well if they place their funds in these pre-vetted investments. Blockchain based projects may find that a stamp from venture capitalists opens doors to opportunities more easily than a project that has only been publicly-funded.

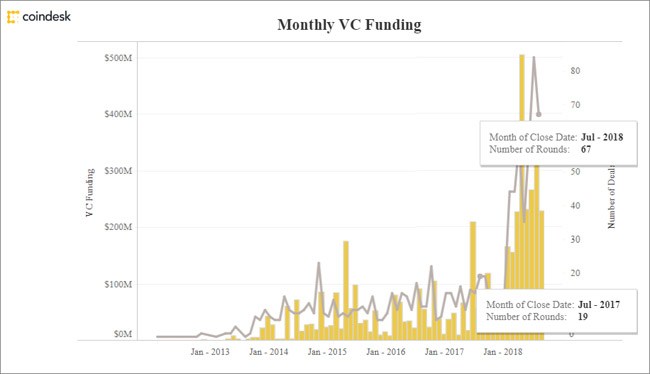

In July 2017, 19 successful funding rounds were reported, where blockchain projects closed deals with venture capitalists for their startups or already established businesses.

Whereas, the number grew to be 67 in July 2018, outlining the stark interest in the new segment of technology.

Venture Capital Historic Graph

This is no doubt courtesy of the potential that the blockchain industry has shown in the past few months. Apart from the billion dollar cryptocurrency sector itself, blockchain has proven to be an emerging point of interest to corporations such as Ant Financial, Maersk, IBM and others as well.

Various entities are responsible for VC funding in the blockchain sector, established firms such as Andreesen Horowitz and Union Square Ventures are only two of the leading names. Whereas, a few high level VC executives have even left their existing firms such as Sequoia Capital to start their own crypto funds. This latter phenomenon has also caused various investors to setup specialized funds that focus only on blockchain and cryptocurrency investments, with the Digital Currency Group being one of the thought leaders in that segment.

While the hype is understandable, this raises an important question.

Just what is it that a VC investor looks for in blockchain investments? In other words, what makes an investment opportunity in a space so lucrative that it lets these VCs provide millions of dollars in funding to these startups?

The answer to that question might never be divulged by any of these companies, especially since most of the time the decision depends upon the better judgement of a few key individuals alone.

However, by looking at the patterns of behavior that a few companies have exhibited in the past, we can try and learn about some of the key elements that make them give the nod in the favor of a particular project.

How Do VCs Select Projects to Invest In

To understand how VCs work when it comes to investments, let’s first take a look at the general criteria for investing in projects.

Team, traction, merits, and potential of the project, and alignment with the fund and vision of the investing firm.

The venture capitalist partner will usually look at the people on the team, their track record, and their expertise. They will then move on to the next important point, traction. Depending on the investor they will look at how much has already been done so far, they will look at the number of users, the process, the costs (unit economics, acquisition of new users) and more.

They will also do an analysis on the merits of the project and the idea, they will look at why it will make a difference and be relevant to the consumer, they will also look at how many customers that the project can be relevant to and how it could potentially get there.

Venture Capital firms will see if their potential investment has alignment with their general thesis or vision and choose projects that fit in with their line of thinking.

Now, since we’ve covered general investment criteria, let’s take a look at some of the current investments of a few prominent VCs in the blockchain.

Most of these investments were made during the respective projects’ startup phase; whereas, some of them were made during later funding rounds.

Andreesen Horowitz

Coinbase – Cryptocurrency Wallet and Exchange

Ripple – Large-scale Cross Border Funds Transfers

CryptoKitties – Blockchain Pets Trading/Collectibles Game

Filecoin – Blockchain Storage

MakerDAO – Stablecoin

Dfinity – General Purpose Computing Solutions

Chia Network – Cryptocurrency Based on a New “Proof of Space” and “Proof of Time” Consensus

Basis – Stablecoin

TrustToken – Asset Tokenization

Decent – Content Trading and Distribution

Analysis:

It can be easy to see why Andreessen Horowitz invested in Coinbase a year after it started. Coinbase made progress and went through Y Combinator establishing itself as an entity that did have momentum and strong potential for the future.

Coinbase planned to serve both merchants and individuals, they provided wallets as well as payment processing solutions for merchants.

Coinbase was vetted, made progress (traction), had a great team and vision and was compliant with regulations from the start. It was a good bet to make. Coinbase never had an ICO.

Ripple as an investment can be a head-scratcher at first, but let’s take a closer look. Ripple was around for a while, it was first called Opencoin and then re-branded to Ripple.

Ripple was founded by Chris Larsen and Jed McCaleb, both of whom had illustrious careers in the world of tech and business. The track record of the founders, the potential of the project and the fact that they were in the industry when it was still fairly new quite possibly played a significant role in their funding.

Cryptokitties – This fairly recent investment makes sense, it came right after crypto kitties showed significant traction, the expectation is that blockchain based games will play a significant role in building the blockchain ecosystem and that Cryptokitties will be able to have more successes in the future.

Cryptokitties did not do an ICO.

Filecoin – This investment also made sense because of the team behind the project, Protocol Labs. Protocol Labs has been instrumental in the space as they have created projects such as IPFS, libp2p, IPLD, Multiformats, Filecoin, and Coinlist. Filecoin itself is also a project that is addressing a pressing need for a large segment of users as well. Filecoin did conduct an ICO and raised over 250 million in their funding process.

Dfinity – The project has a goal of becoming a general-purpose computing platform that should rival the likes of Amazon Web Services and Google Cloud. The architecture should be more secure and simpler to create with, it is supposed to be more efficient, allowing for more productivity.

This project looks viable because it has the potential to serve a large user base.

Chia network was founded by the creator of BitTorrent, MakerDAO and Stablecoin could have significant value if they are adopted as mainstream stablecoins.

Union Square Ventures

CryptoKitties – Blockchain Pets Trading/Collectibles Game

Filecoin – Blockchain Storage

OB1 – Decentralized Global Marketplace

Blockstack – Application and Data Exchange Platform

Mediachain – sold to Spotify

Analysis

OB1 – Openbazaar is right in line with the USV thesis. USV has invested in applications that have improved the online shopping experience for consumers with investments such as ShopsShops, Etsy and other as well.

Open Bazaar will be an interesting investment to watch as it seeks to improve the lives of consumers by creating a fee-less peer to peer environment.

Blockstack aims to simplify the development of decentralized applications. That is certainly a powerful and compelling goal, if Blockstack can enable the creation of more decentralized applications it can help to bring about a more robust decentralized future.

Sequoia Capital

Robinhood – Trading App that Recently Started Cryptocurrency Exchange and Trading

Ethos – Blockchain with Built-in User-friendly Wallet

Binance – Cryptocurrency Wallet and Exchange (the deal fell apart)

Digital Currency Group

Coinbase – Cryptocurrency Wallet and Exchange

Ripple – Large-scale Cross Border Funds Transfers

CryptoKitties – Blockchain Pets Trading/Collectibles Game

Radar Relay – Peer-to-peer Crypto Trading

BitPay – Crypto Payment Solutions

BitGo – Blockchain Security

BitOasis – Cryptocurrency Exchange and Wallet

Ledger – Hardware Wallet

Stratumn – Process-recording Based Blockchain Development

Ethereum Classic – Immutable Ethereum

Zcash – Private Cryptocurrency

Circle – Corporate Cryptocurrency Exchange and Trading

ShapeShift – Cryptocurrency Exchange and Trading

Abra – Cryptocurrency Exchange and Wallet

Analysis

RadarRelay would improve the experience of the ethereum token crypto trader, they would be able to make exchanges right from their wallet without the need for a middleman. That is quite a compelling value for a large base of potential users.

BitPay is useful for both merchants and consumers, as it allows consumers to use their BTC with merchants who accept Visa, it is simple and helps to spend your bitcoins like it was fiat. BitPay has been around for quite a while, has a strong team and has significant traction.

BitGo is a bitcoin payment processor that has clients across the world and charges fees for its services. BitGo provides a valuable service to merchants and has a strong business model.

Abra lets buy and sell cryptocurrencies in a simple manner straight from your mobile application, its business model is simple, charge fees for processing transactions. As long as Abra can attract a substantial base of users and continue to expand products it can continue to grow.

BitOasis and Shapeshift are exchanges that provide a valuable service to users across the world. Their revenues rest on their number of users as well as their daily activity.

By taking a brief look at the list above, it is easy to identify the few factors that are common across all of these VCs.

Innovation

From blockchain-based pets to storage, projects which bring something new to the table seem to be picked up by investors the most.

While CryptoKitties and Filecoin fit the descriptions above, ventures such as Dfinity, Chia Network, OB1, and Stratumn also fulfill this requirement to a great extent. At the start of its operations, Ripple also promised to fulfill the need for corporate fund transfers, which it has continued to do to this date.

All of these projects bring about solutions that sound disruptive and hold a great promise due to their unique nature, and the thought of their potential growth seems to have greatly influenced the decisions of the investors in each of their respective cases.

Stability

Another recurring theme seems to be the focus on stablecoins and cryptocurrencies that in addition to being used as a means of value, contribute towards bringing stability to the market.

Examples in this segment include MakerDAO and TrustToken, which directly relate to predetermined assets; and Zcash, which brings the notion of privacy to the mix.

This adds to the idea that if a project has a solution which could add value to the cryptocurrency and blockchain market in a truly tangible manner, then it also has high chances of being picked up by a VC.

Infrastructure

In a space that is growing exponentially, the need to provide dependable infrastructure is something that will continue to rise in demand.

And that is what projects such as Coinbase, BitPay, and BitGo seemed to have done. Ethos also secured funding with its own take on the same concept, it is safe to say that projects promising credible infrastructure to the blockchain and cryptocurrency community have great chances of securing funding for themselves.

Proficiency

While different aspects are apparent for each of these blockchains, one thing that remains very clear is that none of them secured funding by presenting a half-baked product in the face of the investors. Even in those cases where a product was not yet developed, they had something put together to show to these VCs – which could not have been possible without a proficient team.

From the minds behind Decent to the people who developed ShapeShift, the funding was ultimately secured by demonstrating the ability of their team.

Thus, it can be safely said that if a project does not have a capable and competent team to back its operations, then obtaining funding might not be possible.

Intuition

Sometimes, even the most beneficial of projects that promise great potential on-paper have a few flaws which could cost them their funding. However, it is at those times that VCs make executive decisions and decide to bring those projects to life on good faith.

Such decisions are not always advantageous, but when they are, they pay off big time. Thus, if you notice a project that shows a few key flaws but has been backed by a sufficient VC, then it’s possible that they either might know something that hasn’t been divulged to the public, or they are riding it out based on their personal judgment.

Each of the Most Popular VCs Seems to Be Following a Pattern of Their Own

Taking another close look at the aforementioned list with a different perspective also brings about the idea of each VC following their funding model with a specific frame of mind.

While Andreessen Horowitz and Union Square Ventures seem to be basing their investments on a mix of stable ideas and innovative ventures, Sequoia Capital is more selective (and problematic) when it comes to its investments. We also see that the Digital Currency Group has invested in many ventures that make money from the start, they have clear business models, have traction, earn revenues on a yearly basis and look like they will grow as the industry progresses.

Venture Capitalists might not always be right, just because they choose to invest in a project does not mean that you should either. They are working with different visions and larger bases of capital, their dynamics are different.

It is important to do your own due diligence and not simply ride the coattails of venture capitalists, their investments and portions of their strategies might serve as good indicators and guides but should never drive your capital allocation decisions.

Featured image by New Haircut