OKEx is a relatively new cryptocurrency exchange platform, having been split off from the well established OKCoin exchange in May 2017. As with any cryptocurrency platform there are certainly things to look at to decide if you can trust your coins to them, and with that in mind I’ve put together a review of OKEx to show you what benefits you might get from trading through them, and what problems you might run into as well.

Note that as of May 2018 OKEx is the second largest cryptocurrency exchange by trading volume. Only Binance has more than the over $2 billion in trade volume seen at OKEx.

OKEx History

OKEx is a digital exchange, allowing you to trade cryptocurrencies, as well as cryptocurrency futures. It is this second feature that prompted the creation of OKEx in 2017. It is a subsidiary of the famous OKCoin exchange based on mainland China, and was split off in May 2017 to handle the futures trading part of the OKCoin business, so that OKCoin could focus on fiat/crypto exchange.

While OKEx has its headquarters in Hong Kong, the company itself is registered in Belize. Interestingly, even though they are headquartered in Hong Kong, they do not accept Hong Kong traders.

And recently it was announced that they would be moving their headquarters to Malta, with the official statement claiming it was for security reasons and to include Know Your Customer (KYC) and Anti-Money Laundering (AML) in their process.

The team behind OKEx are considered to be experienced and knowledgeable regarding the world of cryptocurrencies. The CEO is Chris Lee, who has decades of experience in banking and investment, and was named “Best Hong Kong Executive” by Asia Money in 2015.

He is backed up by Tim Byun as CRO. Mr. Byun served as the Chief Risk Officer at Bitpay for 2 years, was the head of Anti-Money Laundering/Anti-Terrorist Financing team of Visa for 5 years, and was also the Examining Manager of the Unites States Federal Reserve for over 16 years. Needless to say, he is a leading figure in the field of Risk and Compliance. Finally we have the COO Andy Cheung, the former CEO of Groupon.

Until very recently the entire OKEx site was available only in Chinese, but with the upcoming move to Malta and assumed move into U.S. markets (I assume this is why they want to include KYC and AML) the site has been completely and professionally translated into English.

Outside the U.S. and Hong Kong, OKEx accepts traders from around the globe, with the exception of those on global watch lists or under international sanctions.

Buying and Selling at OKEx

Previously OKEx accepted only certain cryptocurrencies as deposits and withdrawals, and there was no limit to the amounts you could deposit and withdraw. As of May 3, 2018 while I write this they appear to be changing this, likely due to the implementation of KYC and AML regulations.

I have seen new FAQ entries that are just one hour old referring to fiat deposits, and other new FAQ documents give verification levels and withdrawal limits. Verification is similar to that employed at other cryptocurrency exchanges and can be seen in detail here.

Based on the most recent changes to the FAQ, the daily withdrawal limits for OKEx are as follows:

- Unverified: 0 BTC

- Level 1 verification: 2 BTC

- Level 2 verification: 100 BTC

- Level 3 verification: 9999999999 BTC

Additionally, there are trading limits imposed based on verification levels. Unverified accounts are limited to $2,000 single transactions. This limit is increased to $10,000 single transactions for level 1, $200,000 single transactions for level 2, and $500,000 single transactions for level 3.

Deposits are currently accepted only in cryptocurrencies, although that looks to be changing and OKEx may be accepting fiat deposits by the time you read this review.

As of May 3, 2018 the exchange allows deposits in Bitcoin, Litecoin, Ethereum, Ethereum Classic, Bitcoin Cash, Ripple and NEM(XEM). Note that deposit availability is based on network confirmations for each type of cryptocurrency. A full chart can be seen here.

Withdrawals can only be made in Bitcoin, Litecoin, Ethereum and Ethereum Classic.

Many altcoins are already being supported for trades (75 as of May 3, 2018) and more are being added all the time. You can see a complete listing here.

OKEx Fees

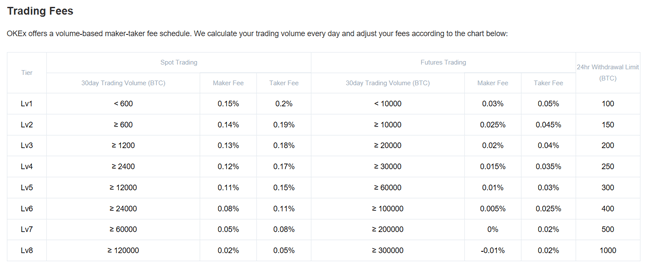

Fees are a necessary cost of trading, and OKEx has fees of course. They are variable based on what tier you’re in and the tiers are dependent on your trade volume. Fees are in-line with industry standards, with maker fees ranging from 0.15% down to 0.02% and taker fees ranging from 0.2% down to 0.05%.

There are a few different tiers of accounts that you can have depending on the trading volume and your overall activities.

The fees are set per tier. The maker fee can range between 0.15% and 0.02% depending on your tier.

The taker fee can range from 0.2% to 0.05% depending on your tier.

OKEx Verification

The only verification needed to begin trading and to make deposits is an email verification. However, if you wish to withdraw your profits you’ll need to provide additional information to get increased verification tiers.

Verification for OKEx follows current industry standard KYC and AML regulations.

Level 1 verification depends on your jurisdiction, but can include your full name, physical address, ID/drivers license number.

Level 2 verification requires you to upload a copy of your ID as well as a photo of yourself holding your ID.

Level 3 verification requires a video to be created and uploaded through the OKEx trading app.

Futures Trading

The primary reason for the creation of OKEx was for trading futures tied to cryptocurrencies. The platform has since expanded, but its core remains as a futures trading platform.

Futures come with lower fees, and the ability to trade with margin, leveraging your purchasing power up to 20x. The main cryptocurrencies offered are Bitcoin, Ethereum and EOS, and contract lengths are available of one week, bi-weekly and monthly, giving traders added flexibility.

Futures can be a great way for the advanced trader to hedge open positions, and with the suite of advanced trading tools built for the OKEx platform, you’ll be able to build exactly the position you need.

OKEx Safety and Security

OKEx claims to have state of the art security measures implemented on-site to keep clients funds secure at all times. Some specific steps they have taken include:

– Coins are stored in cold wallets as a preventative measure.

– Offsite backup is used for any paper documents and private keys held. This backup site is monitored 24/7.

– Private keys are encypted.

– Encryption protocols used are state of the art and integrated within the cold wallet.

– Private key holders and those who can retrieve encrypted private keys are not the same people.

– Any time an address is used for a transfer out of the exchange that address is considered invalid for incoming deposits.

– Private keys are never exposed to the internet, nor to a USB device.

Despite all the security claims, OKEx was the victim of a hack back in October 2017.

The company never revealed the amount of the theft, however the company statement revealed that most of the accounts, which was a small number, were hacked due to improper user security, including the use of simple passwords and a lack of 2-factor authentication protection on accounts.

There’s no reason to think that the exchange isn’t secure in its methods or operation, but users must realize that some of the burden for security is also in their own hands. You should feel secure using OKEx, and to maximize security always use 2-FA security measures.

How to Register and Trade

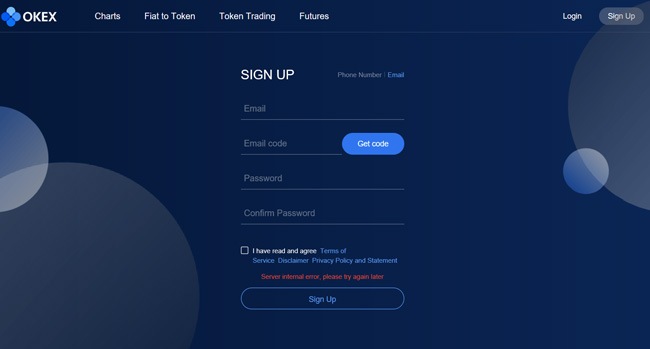

Registering for OKEx is quite simple and requires nothing more than an email address or a phone number as you can see here:

Before you do sign up you’ll be presented with a popup telling you which countries aren’t supported. If you’re in one of those countries don’t bother signing up as there will be no way for you to use the account anyway.

“OKEx presently does not serve customers in the following countries/regions/territories: Hong Kong, Cuba, Iran, North Korea, Crimea, Sudan, Malaysia,Syria, USA [including all USA territories like Puerto Rico, American Samoa, Guam, Northern Mariana Island, and the US Virgin Islands (St. Croix, St. John and St. Thomas)], Bangladesh, Bolivia, Ecuador, and Kyrgyzstan.”

Once you receive the email verification link and click it you’re ready to start trading. Note that you’ll be at verification level 0 however, so you can deposit and trade, but you won’t be able to withdraw. If you want to withdraw (and I imagine you do), you’ll need to provide further personal details to upgrade to verification level 1 or above.

OKEx Customer Service

As with all other cryptocurrency exchanges, OKEx suffers from accusations of slow customer service. In addition to that, if you don’t speak Chinese you’re likely to face some language barriers, but the team says they’re working on resolving this. All I can say is just be patient if you can’t get your question answered in the platform FAQ and you have to actually contact customer support.

In Conclusion

As the second largest cryptocurrency exchange in the world it’s safe to say that OKEx is doing something right. The fact that it got to the number 2 position in less than a year is somewhat astounding, and we can only chalk it up to: 1) the connection with OKCoin and 2) a strong and dedicated management team.

With a large number of coins offered, a new English language website, and the addition of KYC and AML support, there’s a good chance that OKEx might even give Bianance a run for the #1 spot later in 2018.

It’s easy to use, which makes it great for beginning traders, but also has futures and margin trading for the more experienced crypto trader. With top-notch security in place and low fees there’s little reason to trade elsewhere, especially for Chinese language traders.

On the downside, customer support leaves something to be desired, but I feel this issue applies to every cryptocurrency exchange, and I have a feeling that as the space evolves this will eventually work itself out.

Overall OKEx appears to be a trustworthy exchange, and despite the huge volumes of trades there haven’t been many online complaints about the exchange (though to be honest I can’t search for such in Chinese). I do feel safe in saying the exchange is not a scam, and that it does care about the traders it has as its clients.