One of the oldest cryptocurrency exchanges, and also one of the most highly respected, is the Bitstamp exchange. Begun in Slovenia, the exchange has undergone several transformations, and has grown to have one of the largest European user bases, and is a popular choice for cryptocurrency traders across the world, thanks to its global office locations.

Bitstamp Overview and History

Bitstamp was founded by Damijan Merlak and Nejc Kodrič in 2011 in Slovenia as a service aimed at European customers who wanted an alternative to the Japanese run Mt. Gox at the time. By 2013 Bitstamp had grown enough to open an office in the U.K., and it branched out further in 2016 by opening its Luxembourg office, which is now its global financial headquarters. Since then it has also opened a new London office and an office in New York.

Bitstamp is popular with beginning, intermediate and advanced traders who are looking to buy Bitcoin and the major altcoins using fiat currencies. It offers its clients the ability to exchange cryptocurrencies in large amounts at low market fees. Bitstamp has seen its market share overtaken by new exchanges however, and currently only trades just under $100 million per day, with the majority coming in USD trades rather than EUR trades and nearly half of all trades being BTC/USD trades. Coinmarketcap.com shows it as the 13th largest exchanges behind competitors GDAX and Kraken.

Bitstamp Features

- Functionality – As one of the oldest cryptocurrency exchanges, Bitstamp has had plenty of time to design a trading platform that is fairly easy to understand and use. Clients get all the critical information on price and orders, and charts are clean and easy to look at. Bitstamp also provides a mobile app for both iOS and Android users, unfortunately like most of the cryptocurrency exchange mobile app it has failed to impress users, who call it buggy and in some cases even unusable.

- Low Fees – Bitstamp has competitive fees, especially for international wire deposits and withdrawals, where international wire deposits accrue a fee of .05% (minimum 7.50 USD/EUR). International wire withdrawals accrue a .09% fee (minimum 15.00 USD/EUR) and the minimum you can withdrawal is 50 USD/EUR. Trading fees are standard for the industry at .25% per trade for monthly volumes under $20,000. This drops all the way down to .10% for traders with a monthly volume of $20 million or more.

- Security – Notwithstanding the 2015 hack that cost the exchange some $5 million in Bitcoin, the platform these days is very secure, and it is fully compliant with all digital asset regulations and consumer protection laws. These days the exchange places all its digital assets into cold storage, while online assets are hosted on Amazon Web Services. Adding to the security for clients is FDIC insurance for U.S. dollar accounts, with funds being held in a New York chartered bank.

- Customer Support – In an industry plagued by customer support issues Bitstamp is about run-of-the-mill, with most questions answered in an online FAQ document. Users who can’t answer their own questions can take advantage of email based support, with the team aiming for a response within several hours. Local offices do have phone support during business hours for emergency issues or more complex issues.

- International Availability – In addition to be widely available across the EU and the US, the exchange is currently available to over 60 countries. These include Australia, Brazil, China, Hong Kong, India, Japan, New Zealand, Singapore, and South Korea.

Supported Currencies

Bitstamp’s core focus is on Bitcoin and the top altcoins – Ethereum, Bitcoin Cash, Litecoin and Ripple. This is slightly more choice than you’ll find at competitors Kraken and Coinbase. Currently the exchange allows for trade within 12 different pairs linked to the fiat Euro and U.S. dollars as well as Bitcoin.

Liquidity used to be far better at Bitstamp, with the exchange handling some $700 million worth of trades daily, but with the large number of new competing exchanges that trading volume has fallen significantly to just under $100 million per day. This is still sufficient liquidity for trades to go through quickly however, and is nothing to worry about.

Signing Up at Bitstamp and Login

Like most cryptocurrency exchanges it is quite quick and easy to start an account with Bitstamp. Once you’re on their homepage at Bitstamp.net simply click the “Register” link in the upper right corner. The following page will ask for your name, email address and country of residence. You’ll also need to tick the box agreeing to the Terms of Use and Privacy Policy, as well as the box confirming you’re not a robot. Then click the “Register” button.

Once you complete the registration form and submit it you’ll receive an email from Bitstamp with your unique client ID and password. These are automatically generated, and when you log into Bitstamp for the first time you’ll be required to change your password. You will also be encouraged to set up 2-factor authentication, and I highly recommend that you do so for security purposes.

At this point you have just the basic account, which lacks many of Bitstamp’s features, including the very important ability to make withdrawals. If you want to make withdrawals in the future, or gain the ability to make bank wire transfers, you’ll need to verify your account. Bitstamp has both personal and corporate account, but both require the same levels of verification to unlock features. The initial verification requires that you upload the following:

- A valid Citizenship/National ID. Passports and drivers licenses can also be used.

- Proof of residence, this includes a bank statement, utility bill, and a number of other government issued documents.

Once your documents are uploaded there is also a second phase of verification where you need to verify your phone number through an OTP code sent to the phone. After that is complete you’ll have complete access to all the features that Bitstamp offers, including withdrawals by various methods.

Depositing to Bitstamp

You obviously can’t trade until you have money in your account, so the first thing to do after getting verified is to make a deposit. This is easily accomplished by navigating to the “Deposit” tab in the account when logged in. You can fund the account with cryptocurrencies from another wallet or exchange, by bank wire transfer, and by debit/credit cards. A bank wire transfer typically takes 2-5 business days and SEPA transfer 1-3 business days to reach your Bitstamp account. Credit and debit card transfers are instantaneous.

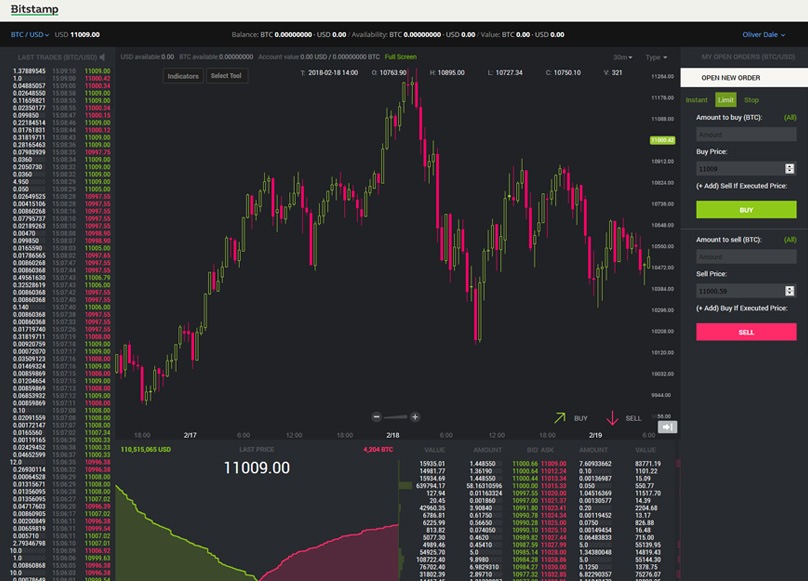

Trading on Bitstamp

Once your deposit has cleared and your funds are available in your account you’re ready to trade. This is done easily by choosing your trading pair and then clicking either BUY or SELL on the right side of the chart. You’ll need to decide if you want a market order or a limit order, and of course will need to specify the quantity to buy and your expected price.

Once your purchase is complete you’ll receive the cryptocurrency you purchased as a deposit. You can then exchange it for a different cryptocurrency, sell it again for profits, or transfer it to an external wallet or another exchange.

Bitstamp’s fee schedule is very competitive when compared with other exchanges. You’ll find a comprehensive fee listing here, but the major fees are listed below:

- International Wire – 0.05% Deposit fee (minimum fee = 7.5 USD/EUR, maximum fee = 300 USD/EUR). 0.09% Withdrawal fee, minimum fee is 15.00 USD/EUR. Bank wire transfers may incur additional international bank fees.

- SEPA – Deposits are free of charge. Withdrawals are 0.90 EUR.

- Credit Card Purchases – 5% flat fee for all amounts (an additional fee may be charged by the card issuer).

- Debit Card Withdrawals – $10 Fee for deposits up to $1000.00. Deposits greater than $1000.00 will have a 2% fee assessed.

- Trading – Costs .25% for monthly volumes under $20,000 this drops all the way down to .10% for a monthly volume of over $20 million. All non-USD trading volumes are converted to USD using a spot exchange rate at the time of each trade.

- Cryptocurrency – Cryptocurrency deposits and withdrawals are free of exchange fees, but are still subject to any network transfer fees.

The minimum allowable trade is 5 EUR for Euro denominated trading pairs. The minimum allowable trade is 0.001 BTC for BTC denominated trading pairs. The value of minimum trades in other trading pairs will be denominated in the fiat currency of the particular trading pair and limited to 5 whole units of that currency (example: $5, £5, etc.).

Are you Safe Trading at Bitstamp?

Safety is always a top question when considering cryptocurrency exchanges, considering all of them have very limited history. While Bitstamp did suffer some hacking issues in 2014 and 2015, with the latter hack resulting in 19,000 Bitcoin being stolen, and the exchange shutting down for several days as a result, the question of security becomes even more important.

The good news is that Bitstamp really learned a lesson from those hacks, and as a result they have one of the most secure trading platforms available. I guess it’s a case of one bitten, twice shy as they don’t want to go through a similar incident again. All customer wallets have been secured, and 98% of the exchange funds are held in secure offline cold storage, keeping them inaccessible to potential hackers.

In addition, funds are fully insured and the addition of 2-factor authentication, mandatory confirmation emails and SMS alerts keeps customer accounts as secure as possible. To further secure data, Bitstamp uses PGP (Pretty Good Privacy) encryption for authentication and privacy of all uploaded files.

The end result is that since the 2015 hack, Bitstamp has made the necessary changes to gain the reputation of one of the most secure cryptocurrency exchanges.

Bitstamp’s Pedigree

You aren’t going to find many cryptocurrency exchanges with the connections and achievements of Bitstamp. It was the very first Ripple Gateway, and also the first partner in the Ripple incentive programme. Showing its standing in the financial community is the partnerships it has formed with Swissquote and Credit Agricole SA (CACEIS). Furthermore, it was the first cryptocurrency exchange to be fully licensed in Europe and is regulated now by the Luxembourg Financial Industry Supervisory Commission (CSSF). This ensures full compliance with relevant regulations, and periodic reporting to relevant agencies.

Among the cryptocurrency community the exchange has a good standing, and reviews are primarily positive, with the exception of customer service. As is the case with most of the cryptocurrency exchanges, people haven’t been pleased with receiving support via email and through social media channels, especially when responses can take 24-72 hours at a minimum. There were also complaints about the verification process during a surge in new registrations early in 2018, but Bitstamp has cleared that up and verifications are flowing smoothly now. In general the exchange takes good care of its clients, and is providing a secure and reliable trading platform for the largest cryptocurrencies.

In Conclusion

As one of the oldest cryptocurrency exchanges, Bitstamp has been a leader in the industry for most of its existence. Although it offers a limited number of the top coins only, it has been a solid gateway into cryptocurrencies for many new traders over the years, and continues to be a solid choice for beginning and intermediate traders looking to purchase the top-tier cryptocurrencies. Low fees, solid financials and security, and a good reputation are all excellent reasons to choose Bitstamp.

The platform could certainly use some additional coins, but for those looking to buy and trade Bitcoin, Ethereum, Ripple, Litecoin, and Bitcoin Cash, Bitstamp will certainly meet your needs. It is especially attractive to European traders due to the extremely low SEPA withdrawal fees, but users in Asia and North America can benefit from the overall low fee structure and security of trading here. One thing we would like to see is more emphasis on customer service, perhaps the addition of online chat, or even a customer service support phone line would make Bitstamp standout from its competitors in this regard.