The increase of investments in the cryptocurrency industry has paved the way for new business models to come forward. While most of them focus on ventures that cause investors to buy and hold more cryptocurrencies, some of them have been looking into the possibility of doing the opposite.

Cryptocurrency lending platforms are a new and innovative way for cryptocurrency investors to liquefy their digital assets without having to part ways with them completely. While a number of them have lately come to surface, two of them stand apart due to their popularity within this segment.

In this review, we will be taking a close look at both of those projects, namely Salt and ETHLend, in order to deduce which one deems to be the better platform for their users.

But before we do that, let us take a thorough look at how these cryptocurrency lending platforms work and why exactly they are needed.

What is Cryptocurrency Lending?

Those who have heavily invested in cryptocurrency often find themselves short of liquidity. While bitcoin and other related assets are supposed to function as “digital cash”, they seem to falter in that regard and don’t rise to that moniker. Cryptocurrency today is not truly seen as a currency, it is seen as an asset and therefore, it is not widely accepted as a means of payment.

Neither side, has a significant incentive in trading the asset, the buyer of a good or service does not want to lose out on the potential gain in the value of the asset and the seller of a good or service does want to deal with the volatility.

Those who do want to use their crypto do have a couple of options. One way to turn digital cash into fiat is to sell that cryptocurrency, this can be done through Bitpay, TenX and other companies in a simple and intuitive manner.

Yet, if a user chooses to go with the more traditional option of selling their bitcoin or other cryptocurrencies through their cryptocurrency exchange, they would run into some issues. These issues include high exchange rates that will be incurred, as well as the fact that it would rob investors of the opportunity to benefit from any expected rise in their cryptocurrency’s value – especially if they only need the cash for a short amount of time.

While it is an expected scenario for everyone and remains manageable for those who buy their cryptocurrency with funds that they were going to invest in other non-liquid assets anyway, it creates a big issue for the everyday investor who does not have that much funds to spare, and only invest in cryptocurrencies with whatever little they have.

Since most small-scale investors in cryptocurrency invest in these digital assets with their “additional” funds, or funds that they had saved to be put away for future use, they often need actual cash in its place in case of emergencies. As noted above, they resort to selling their cryptocurrency and end up getting hit by transactional costs and losses on future gains.

Cryptocurrency lending platforms save large and small-scale investors from these troubles by letting them use their cryptocurrency investment as collateral for short-term loans. By using these platforms, investors can lock their cryptocurrency assets in exchange for loans in either fiat or cryptocurrency without having to sell their assets.

And that is the model on which Salt and ETHLend operate for their users.

What is Salt Lending?

Salt, also known as Salt Lending, is a cryptocurrency-based lending platform that operates out of Denver, Colorado. It is built on top of the Ethereum blockchain and accepts Bitcoin and Ethereum as collateral to a fiat-based loan, where the amount is disbursed directly into the borrower’s bank account upon the approval of their loan application.

Launched in September 2016, the platform started gaining traction as the cryptocurrency industry garnered increasing popularity in 2017. That was when Salt doubled down on its marketing efforts as well, especially by the third quarter of the year.

The SALT platform provided real value, it acted as a way for those early cryptocurrency investors to convert the wealth provided by the rise in cryptocurrency prices and benefit greatly. These investors didn’t have to sell their crypto, they could still hold it and borrow against the value.

The SALT model and the market conditions worked greatly in the favor of Salt and brought it forward as a leading solution to convert digital wealth to real-world cash – all without having to do away with one’s cryptocurrency holdings completely.

How Does Salt Lending Work?

How Salt worked and still works is simple on paper, even though a few steps seem unnecessary.

Those who want to convert their cryptocurrency investment into cash but do not want to sell their digital assets can buy SALT tokens from any exchange that trades them and use them to purchase a membership on the platform.

There are different membership tiers on the platform, where each of them assigns different borrowing limits to each user’s account. It is important to note that the Salt platform recently went through a major overhaul where it did not only change its previous membership fees but more aspects as well.

The SALT platform changed its calculation of the price of the Salt tokens (more details on the overhaul are provided in a separate section below).

When a cryptocurrency holder signs up with the platform and completes its know your customer (KYC) procedure, they can utilize Salt’s services in 30 jurisdictions (according to its website). SALT is not only available in many states of the United States but also in territories such as Puerto Rico, Bermuda, Brazil, the UK, and other countries as well.

Potential borrowers can submit their application to the platform, which the Salt platform reviews before letting them know whether their application could be approved.

The SALT platform is very streamlined, it has no loan origination fees, no prepayment fees, direct deposit into the bank, no credit checks, quick loan approval, terms ranging from 3 months to 36 months and APR’s that can range from 9.99% to higher rates.

Upon successful approval of an application, borrowers go ahead and deposit their cryptocurrency as collateral into a special wallet created by Salt, where the cryptocurrency is kept for the tenure of the loan.

The borrower receives the cash in their account shortly after, from where the borrower could make monthly payments to the Salt platform until they fulfill the repayment of their loan and get their cryptocurrency back. The terms of the loan, the repayments and the release upon the loan’s ending are all executed through Ethereum smart contracts.

As mentioned earlier, this model seems simple on paper, but provides a few unnecessary elements within it.

The Problems with Salt Lending

For starters, it was first mentioned by the platform that Salt tokens will be used to pay loan interest as well as loan repayments on the platform. Salt tokens were initially sold at around $7 each, where they hit their peak in December 2017 at $16. However, on the platform, they were attributed to being valued at $25 at all times.

This led people to believe that they were getting a huge arbitrage opportunity through Salt. Since they were getting Salt tokens for one-third the value of the platform, this alluded towards the possibility that if they take out a loan, then they could save more than half of its amount in repayments while still retaining their cryptocurrency.

However, this did not seem to be the actual case at all. Salt did not approve loans left and right as it promised earlier: in 2017, Salt’s website mentioned that it was in the process of disbursing loans for around $300 million. But today, its website states that it has only loaned out $50 million so far.

That largely had to do with how it suspended any new loans or user requests in February 2018. On a positive note, that seems to be changing, since platform reported in August 2018 that it has expanded its operations to over 30 states within the U.S.

If you can learn one thing from Salt, it is that any positive feelings you derive from the platform cannot last for long. The promise of having Salt tokens function for interest and loan repayments has gone down the drain. The platform no longer accepts Salt for anything except for membership fee.

Due to this, many people on various social platforms still accuse Salt and state that it has cost them a lot of money. The token now trades at less than $0.50 on an average basis after being sold at the initial amount of $7.

Statistics courtesy of unblock.net

The Salt token’s only use has now slimmed down to becoming just one case, the purchase of a membership. Once the membership is purchased, the Salt token is essentially never used for any other purpose on the platform since the cryptocurrency repayments are made through fiat, directly from the borrower’s specified checking account.

This makes Salt token a buy-and-sell instrument, since no one who has paid for their membership would go and buy the token again or hold it in hopes for an increase in its value.

The value for Salt tokens also differs after the aforementioned overhaul. The value of a Salt token on the platform was equal to $25. But now, the value varies and is set by Salt platform itself on a fluctuating basis. This decision of setting its token’s value not through the exchange but by its own self heavily tips the scales in the platform’s favor.

Another issue is of “margin calls”, where the platform asks borrowers to deposit more amount as collateral if the value of their collateral cryptocurrency falls below a certain point. If that is not done, then the borrower loses their assets.

Yet another problem is how the platform operates in terms of its lending model. While the loan application is processed faster than banks with no checks on a borrower’s central credit history, it also comes with largely varying interest rates that are decided by the platform as well.

And Salt misses a huge opportunity to actually benefit small-scale users here: it selects its lenders only from a pool of large-scale investors with a net worth of $1 million or more (which are also termed as accredited investors by the U.S. Securities and Exchange Commission).

This creates an air of exclusivity with the platform, barring those who may benefit by lending small amounts to borrowers. But to that point’s benefit, the action is understandable, since it saves those investors from losing money who cannot afford to do so.

But once again, when you start thinking positively, that mindset gets challenged by another action by Salt. The notion of Salt only favoring millionaire investors is strengthened by an otherwise positive profile by the Wall Street Journal that actually paints Salt as an elitist platform that only serves the millionaires’ interest.

In a community that was created on the very idea of decentralization, this approach does not seem to be sitting well with a number of people on various social media platforms, who keep calling out Salt for not loaning money to them despite taking their Salt tokens in terms of membership.

Another issue here is how the project’s co-founder and CEO Shawn Owens left the company abruptly soon after the glorified profile in WSJ, amidst rumors that the platform was going to be an exit scam.SALT then went silent for a while on all social media platforms.

It resurged with a few changes.It has replaced Owens with an interim president and CEO in the form of Denver resident Bill Sinclair.

Seeing all these negative developments, our advice would be to stay away or test the waters with SALT going forward. The platform looks like it is at least trying to get its house in order. So far, the platform is operational, it is interacting with the community and is making progress across the board.

To summarize, it has to prove that its worth its salt; otherwise, the little user base that it has left from the 70,000 users that it boasts of will stop following it as well.

And after that tale full of twists and turns, we now move towards ETHLend.

What is ETHLend?

Based in Chiasso, Switzerland, ETHLend is a relatively new platform that was launched in the third quarter of 2017 and concluded its ICO on the 30th of November, 2017.

If the name has not already given it away, ETHLend is based on the Ethereum platform and allows cryptocurrency investors to borrow funds against assets based on the Ethereum blockchain, which are also known as ERC20 tokens. The loans can be given out in ETH and the blockchain’s own native token by the name of LEND.

But that’s not all.

Apart from lending out ETH and LEND in exchange for any ERC20 token as collateral, the platform also offers fiat-pegged loans in USD against those tokens. This means that while borrowers will still receive their loan in cryptocurrency, they can peg the loan amount to USD in order to save themselves and the lenders from any financial exposure due to fluctuation in their collateral’s value.

The platform also accepts ETH as collateral, but it does not allow USD-pegged loans against it and only offers LEND in that case.

How Does ETHLend Work?

The process on ETHLend is quite automated. From loan calculation to monthly repayments and settling unpaid loans in the favor of the lender, all actions are completely performed through smart contracts on the platform.

The application remains decentralized, where lenders are directly connected to users without ETHLend’s team being involved in the project or holding the assets in their grasp. Instead, when a loan agreement is reached between a lender and a borrower who were connected through the platform and agree upon the terms of the loan, the collateral is locked within the blockchain through a smart contract.

From there, it is only released either upon successful completion of the loan or the borrower not making their payments in a timely manner for a certain duration. In the case of the former scenario of a loan term being reached with proper payments, the borrower gets their collateral back unharmed; whereas, when the latter situation occurs with a borrower being late on their repayment, the smart contract allows the lender to have the amount released to them according to the terms of the loan.

Due to this automation and lack of the involvement of a third party, the processes are faster as well. Instead of lenders deciding upon how much amount to give against a certain collateral, all of those limits remain pre-defined on the blockchain and save the borrower significant time upon their loan application.

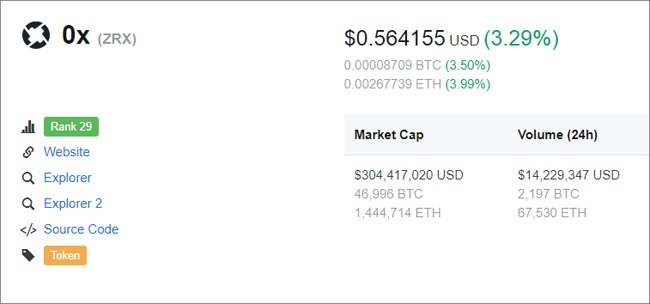

For instance, at the time of this writing, 0x Project’s ZRX token was valued at $0.56 (we selected it as it was alphabetically the first ERC20 token on the platform).

Statistics courtesy of CoinMarketCap

We asked the ETHLend platform how much could be received in exchange of 1000 ZRX which were valued at $560. We got the result of $423.

This means that ETHLend can easily loan you around 67%-80% of your collateral with no hidden processes or personal discretions on that front, since the processing fee is shown right along with the estimate. The said processing fee can also be waved off if you used LEND as collateral.

Thus, LEND cannot only be used in fees and loan disbursement but can also be utilized as collateral with additional benefits as well, such as the availability of a Premium Feature which allows professional lenders to pick up loan requests before other lenders.

Borrowers that want to utilize ETHLend services can sign up to the platform. From there, they can place their loan request on the decentralized application (DApp), transfer their collateral to the smart contract and wait for a lender to pick up the loan request. Here, they can select the currency they want the loan amount to be calculated in. For instance, they can choose ETH, or peg the value of the asked amount to USD. As mentioned above, the latter option saves both parties from any uncalled for fluctuation in value especially in long-term loans.

Similarly, a lender can see a loan request they like, fund it, and initiate the smart contract accordingly. It is as simple as interested parties being connected through a decentralized platform – with the added assurance of the security and transparency of blockchain technology.

It should also be noted that loan repayments are always done in ETH.

This propitiously set system has caused ETHLend to rise in popularity. While the platform was only started less than a year ago, at the time of writing, it has already seen a total volume of 9,155 ETH in transactions. That currently adds up to more than $1.9 million.

The platform has at least 153 loans active at the current moment and according to the platform, the most active collateral used for loans is their own asset, ETHLend. Why would it not be? There’s no fees associated with ETHLend.

ETHLend will have a few updates to go live in 2018, these updates include the integration of bitcoin lending, reduction of gas cost with a better smart contract architecture, in app wallet solution, addition of more altcoins and tokens.

The Problems with ETHLend

ETHLend has defined each and every step of its platform in a very detailed whitepaper and a separate FAQ section, so there is not much left to obscurity here. However, a few issues still exist with the platform which has more to do with the overall structure of cryptocurrencies than the platform itself.

While the platform takes extensive measures to protect both borrowers and lenders from the volatile nature of cryptocurrencies, there is only so much it can do.

For instance, its currency pegging does work very effectively, but there are instances where the provided collateral’s value could drop from a certain point. If this affects the collateral percentage against the loan, then a lender can choose for the contract to end and have the remaining amount released to them before they could incur any further losses.

This is not a problem with ETHLend, it is more with the volatility in the markets.

his means that losses could be minimized, but still does not overcome the fact that losses could be there. Furthermore, the tokens that they receive from the collateral might be prone to the risk of further loss, which is why it is extremely important for lenders to be vigilant on the platform.

On the other hand, this collateral calling feature effectively keeps a borrower on edge. If they are not careful, then their cryptocurrency’s value could drop without their knowledge, to the point where it gets claimed by the lender without the borrower being able to save it.

Salt vs. ETHLend – Which One is Better?

In their original form, both of these lending platforms bring something original to the table. However, while Salt offers cash-based loans against Bitcoin and Ethereum, it has proven to be a faltering project when it comes to service delivery. Whereas, ETHLend, even while only providing cryptocurrency as a means of value, still provides its services to its users with a slew of ERC20 tokens that it accepts without any problems.

Furthermore, while both projects have margin/collateral calling which put investors and borrowers at risk, ETHLend has plans of expansion, which unlike Salt’s recent plans do not manifest out of a debacle but as a natural progression of the brand itself.

While Salt’s token does not provide much use, ETHLend’s token has a holistic approach towards the platform’s functionality and with the aforementioned plans to expand its platform, ETHLend plants to extend the scale of LEND’s usage as well.

It is safe to say that ETHLend wins this round. If you need your cryptocurrency investment to serve as a loan collateral, then ETHLend might be a better choice of the two.

Featured image courtesy of Tony Gines