Monaco has been tackling the area of online banking with a cryptocurrency solution. It’s an incredibly useful project that allows users to hold their cryptocurrencies alongside fiat currencies.

Each user gets a free account and a Visa card to spend crypto and fiat in their account at any location accepting Visa debit cards. And that’s not all.

Currency conversions are made in real-time, so you can use the card in any country. Payments will be made in the appropriate currency, and the user doesn’t lose anything in the conversion. It gets better!

Monaco has also released their own token – MCO – and every time you use one of their Visa cards you earn MCO tokens at the rate of 2% of your transaction.

This article will take a closer look at a project that is attempting to bridge the gap between cryptocurrencies and use in the real world.

Monaco Can Save You Money

You’ll save immediately because a Monaco account is 100% free, with no minimum balance requirements like at traditional banks, and no penalties or other fees.

If you travel and do transactions in multiple currencies you’ll save any fees incurred through exchange rates because Monaco doesn’t charge you for exchanging currencies and it doesn’t use spreads. Monaco gives you the real exchange rate.

That’s huge!

When you consider banks will charge you anywhere from 5% to 10% on currency conversions you can immediately see how much this might save you. This makes Monaco extremely appealing to those who use multiple currencies and crypto assets.

And we already mentioned the 2% rebate you get on each transaction. That can add up very quickly, especially if you’re using your Monaco card for large transactions, or even everyday purchases.

Monaco is Best for these Groups

Monaco has benefits for any user, but it was designed to offer the greatest benefits to several different groups. One of those groups is frequent travelers who don’t want to see their budget eaten up by exchange fees.

Monaco has no exchange fees so using it anywhere is just like using local currency. You’ll get the best interbank rates no matter where you’re from or where you’re spending.

But there’s more.

Cryptocurrency enthusiasts also appreciate Monaco’s advantages. I mean who would like the great conversion rates and cashback bonus on all your purchases. Those who prefer to use cryptocurrencies especially appreciate that cashback come in the form of MCO, the native Monaco cryptocurrency.

No other cryptocurrency wallet or exchange that I know of gives you cash back on all your transactions. Not one.

And Monaco is extremely useful to those who send money across borders in a regular basis. Unlike traditional banks and other money transfer services there are no fees with Monaco. The transfer occurs immediately, not in 24-72 hours like bank transfers, and there is no transfer fee for the sender or the receiver.

There’s more to learn about Monaco, so stay with me.

Monaco Review: What else can you do with Monaco?

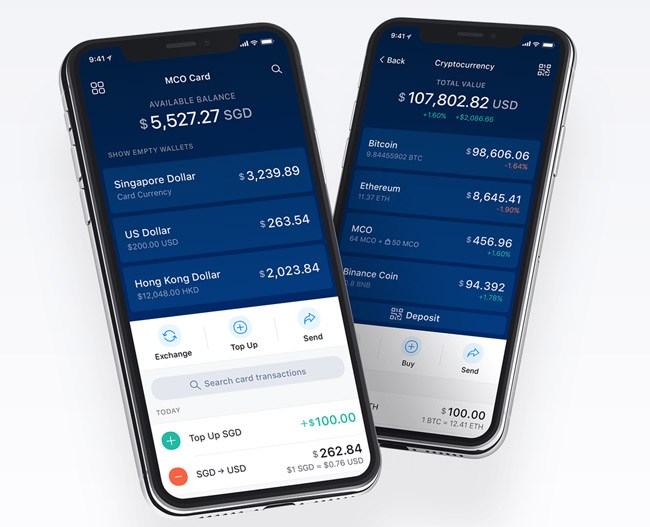

A Monaco account and Visa card allow you to do all the same transactions you would with a traditional bank account and debit card. You can hold, spend and exchange currencies, but unlike traditional banks the Monaco account lets you hold many different currencies in the same account, including the increasingly popular cryptocurrencies.

Since your Monaco account comes with a Visa debit card you can use it to manage most of your expenses, and top it up with your preferred cryptocurrency or fiat currency whenever necessary. Transfers can be made via cryptocurrency wallets, bank transfers, debit cards and credit cards.

You can pay with Monaco at more than 40 million locations worldwide, and recently they’ve begun installing Monaco ATMs that allow to make withdrawals in local currencies. So go ahead and hold your money, send it to others, make purchases, and convert it without excessive fees.

Here are more useful features.

Monaco also has an excellent mobile application, making it even easier to manage your Monaco account. It’s available for iOS or Android and comes with instant notifications to help avoid fraud, and notes that you can add to your purchases to remember what they were for, or which budget category they belong to. And there’s even a budget function.

Monaco Review: Introducing the MCO Token

The MCO token is the native currency of the Monaco network. You can earn MCO tokens for every transaction you make as a 2% cashback. MCO tokens are traded on many of the top cryptocurrency exchanges, so you’ll never have a problem buy them, selling them, or simply swapping for your preferred cryptocurrency.

The MCO token is an ERC-20 token based on Ethereum’s blockchain. This gives it world-class security and the ability to store it in any ERC-20 compatible wallet.

Monaco Review: Comparing the Monaco Visa Cards

Monaco has six different levels of cards available based on your holdings of MCO tokens. The base level is completely free however, with no MCO holdings required. Each higher level increases the benefits you receive.

Here are the cards and a brief description of each:

Midnight Blue – This is the base level card, and there’s no requirement for any MCO purchase or holdings. This gives you basic features of up to $2,000 in free bank transfers and $200 in free ATM withdrawals per month. Unfortunately this level card does not come with any cash back, but there are also no fees for owning or using the card.

Ruby Steel – This card is unique in that it is made of steel rather than plastic. It requires a minimum purchase of 50 MCO which must be held for 6 months. It grants the holder up to $4,000 in free bank transfers and $400 in free ATM withdrawals per month. The cash back rate for this card is 1%, and you get $500,000 in travel insurance.

Jade Green & Royal Indigo – The Jade Green and Royal Indigo Monaco cards are available to those who purchase a minimum of 500 MCO and hold it for at least 6 months. They come with free bank transfers of up to $10,000 per month and up to $800 in free ATM withdrawals per month. The cash back rate for these cards is 1.5% and you also get the exclusive LoungeKey airport lounge access.

Icy White – The Icy White Monaco card requires the purchase of a minimum of 5,000 MCO that needs to be held for a minimum of 6 months. Like the prior level it comes with up to $10,000 bank transfer and $800 ATM withdrawals for free every month. It also includes the LoungeKey airport lounge access for yourself and 1 guest as well as the MCO Private Crypto Concierge. And you get 1.75% cash back on every transaction.

Obsidian Black – The Obsidian Black is the top tier Monaco card and it requires a minimum purchase of 50,000 MCO that is held for 6 months. For that you get 2% cash back on every transaction, as well as unlimited free bank transfers and up to $1,000 in free ATM withdrawals per month. It also includes the LoungeKey airport lounge access for yourself and 1 guest as well as the MCO Private Crypto Concierge. The Obsidian Black is a limited edition card and there are only 999 cards that will ever be issued.

Isn’t Monaco Against Satoshi’s Vision?

Visa is a traditional payment system and most crypto die-hards consider using a Visa card, even for crypto transactions, to be a sell-out move. It’s pretty clear Satoshi wanted to replace traditional banking systems, not work with them.

Honestly it’s up to you to decide if using a Visa crypto-card is acceptable.

In most ways it’s really a philosophical debate. Relying on the centralized Visa network undermines the appeal of cryptocurrencies. However, Visa has a dominant position in global payments systems and partnering makes sense to bootstrap the reach of the Monaco network.

You can decide for yourself if the ends justify the means in this case, but it’s almost certain that there will be other blockchain projects trying to address the same issues as Monaco, and they could very well use existing banking and payments networks.

A Borderless, Fee-free Account

Monaco cards are largely backed by cryptocurrencies, which avoids the border issues that plague fiat currencies. A Monaco card can be charged with Bitcoin or Ethereum or another cryptocurrency and used in any country. Payments will automatically be made in the local currency, without worrying about huge exchange fees.

These low fees and exchange rates work globally. Monaco passes along the same exchange rate they receive as an institutional trader. And I assure you that’s much lower than retail exchange rates, which is what most credit and debit cards charge for currency exchanges.

In fact, Monaco is connected with eight of the top ten international banks to ensure the best interbank exchange rates on every transaction.

This benefit alone should be enough to attract anyone who travels fairly frequently. I’m thinking a savings of 5-10% on any international trip would be possible with the Monaco card.

And what about crypto-enthusiasts?

Well, the Monaco card affords them one of the best ways to spend cryptocurrencies without the need to convert back to fiat. Monaco handles all that seamlessly and without excessive fees.

Monaco Review: Security

Of course security is always a hot topic in cryptocurrency projects.

Monaco comes with all the security features you’d expect to find from global banking and payment systems:

- Block and unblock the card with a tap in the app;

- Enjoy contactless payment and turn it on and off at will;

- Turn ATM usage on and off instantly;

- Instant transaction notifications sent to your phone;

- File chargeback claims if necessary;

- Fraud protection systems will block unusual transactions;

- 24/7 customer support. Speak to a real person.

Regulation and Compliance

Compliance with global regulations has been a huge issue in the crypto space in general, but this has been magnified in payment methods backed by cryptocurrencies.

Monaco has been developing a compliant Visa card longer than anyone, and have partnered with industry leaders to provide compliance services and the Monaco cards.

Gemalto is the company that’s producing the physical cards. They’re an international card manufacturer with an established history of producing Visa cards.

Thomson Reuters World-Check is providing KYC/AML verification.

Jumio will take care of ID verification and other identity services.

Finally, a level-one PCI DSS-compliant Visa/Mastercard processor will handle all transaction processing for Monaco cards.

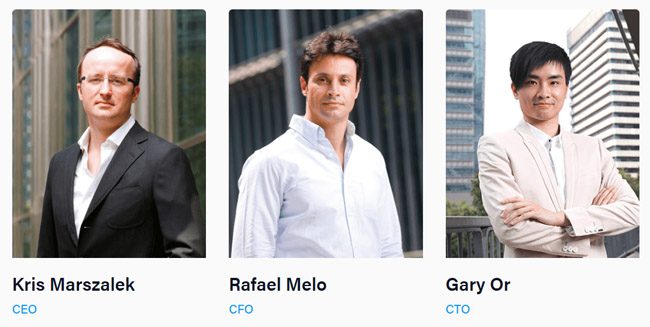

Monaco Review: The Team

The Monaco team has continued to grow into a stronger operation since their early beginnings. The crypto community has learned that they are very responsive and transparent regarding the challenges they face.

This has been a breath of fresh air in the crypto ecosystem.

Of course this open and transparent mindset comes from the top down.

The CEO of Monaco is Kris Marszalek, who was also CEO at Ensogo during its rapid growth phase. He’s been a serial entrepreneur in Southeast Asia for more than a decade and has had a hand in taking many companies from $0 to millions in revenues. While some investors have been nervous about Marszalek as CEO because Ensogo collapsed soon after his departure, there’s never been any evidence that he had any involvement in Ensogo’s demise.

The CFO at Monaco is Rafael Melo, a 15-year veteran of finance, risk compliance and mobile payment systems in Asia. He is also a former Ensogo executive, working there as CFO and leading funraising efforts that brought in over AUD$50 million from investors such as Blackrock, Fidelity, and Goldman Sachs.

Monaco’s CTO is Gary Or, who has had 10 years of full stack engineering experience and has been both product designer and entrepreneur. Hi primary interests are in machine learning and artificial intelligence.

The remainder of the team at Monaco consists of seasoned executives. This is one of the strengths of the projects as the team brings a wealth of experience and a degree of professionalism in messages and images associated with the Monaco project.

Monaco Review: The Future of Monaco

Monaco is working in an alpha phase currently, sending a limited number of cards to users for review and testing. Currently they are working in Asian countries, but will soon roll out en mass to Europe and about 30 different countries. Finally they will move to North America for the final stage.

If you’re interested in receiving a Monaco card it’s been strongly suggested you register and reserve your card as early as possible. The Monaco team has indicated they expect far more demand for cards than capacity to deliver cards initially.

Eventually the Monaco team also intends to offer Crypto Invest and Crypto Credit. The former will let you invest in one of three “funds” set up by Monaco, while the latter will use your crypto deposits as collateral for lines of credit.

Monaco Review: In Conclusion

If you hold multiple currencies or are a frequent international traveler the Monaco card is going to make perfect sense for you.

With the Visa payment system backing the card it should be accepted globally nearly everywhere, and that will be extremely convenient. In fact, with no exchange fees the Monaco card would even be suitable for frequent travelers who deposit nothing other than fiat currencies.

When will the cards ship? Well the closed beta in Asia that launched in March was certainly a step in the right direction after two years of promises. Initially the promise was for cards to ship in the first quarter of 2018 in Asia, the second quarter of 2018 in Europe, and the third quarter of 2018 in North America.

Based on the delay it looks more realistic to think European cards might ship by the end of 2018 and North American cards will take until 2019 to ship.

That doesn’t do away with the suggestion from the Monaco team to register now for your card. If this is the first functioning cryptocurrency Visa debit card demand is likely to be very strong.